3 Stocks To Buy For A Decade Of Gains

Get the insider tip on three stocks with red-hot growth that could top your portfolio gains for the next 10 years. Bret Jensen sees seven specific reasons why these stocks deserve a spot in your portfolio.

The Trump administration is still trying to pivot from failing to repeal and replace the Affordable Health Care Act. While there is some chatter that Congress might try to resurrect the effort in an effort to get it passed in the House, I put little probability of the success of any such initiative. In addition, even if the bill somehow miraculously makes it through the House, it is hard to see how it would survive moving through the Senate, where the Republicans have an even smaller margin for defections.

This means the major focus in the second quarter for the new POTUS will be around Tax Reform as well as continuing to repeal many of the regulations his predecessor put in motion during the last stages of his administration.

The market will be watching these efforts closely as a large part of the post-election rally was based on the expectation that some form of tax reform would be implemented and business regulations reduced. Both are key needs in order to get the economy back on a growth track after over seven years of the weakest post-war recovery on record.

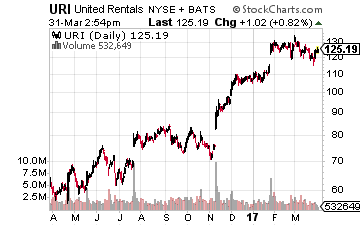

Increasing spending on infrastructure is probably going to be put on the back burner until if and when tax and regulatory reforms are implemented. This means any increase in government spending on infrastructure is probably off the table until late 2018, and probably more likely 2019. Given some of the huge runs some of these stocks like United Rentals (NYSE: URI) have made since the election, I believe this section of the market remains vulnerable to profit taking.

Increasing spending on infrastructure is probably going to be put on the back burner until if and when tax and regulatory reforms are implemented. This means any increase in government spending on infrastructure is probably off the table until late 2018, and probably more likely 2019. Given some of the huge runs some of these stocks like United Rentals (NYSE: URI) have made since the election, I believe this section of the market remains vulnerable to profit taking.

However, I am still positive on the housing market for myriad reasons:

- It is not dependent on an infrastructure bill getting passed by Congress.

- We have had a decade of far below trend housing starts even while the population added some 20 million individuals over the past ten years.

- Household formation is significantly above pre-financial crisis levels again.

- We have seen faster job and economic growth trends in recent months and consumer confidence levels are at levels not seen since December of 2000.

- The spike in mortgage rates since the election seems to be moderating.

- We have seen strong recent readings from the housing market recently including robust new home sales in February as well as strong housing starts for that month.

- The administration’s major campaign pledge was to ignite faster job growth in the country. They are more than incented to do everything possible to boost the housing industry. Each new housing start means three additional jobs in the economy. Getting housing starts back up to their long-term averages could add nearly one million jobs to the economy.

In addition, since homebuilders tend to be 100% domestically focused, they could be large beneficiaries of any tax reform efforts that lower the corporate income tax rate which currently is the highest of the G7 countries. They don’t have overseas operations that are subject to lower tax rates and thus small and mid-cap firms on average send five cents more per dollar of profit to Uncle Sam than the multi-nationals that largely make up the S&P 500.

The industry might also be marginal beneficiaries from regulatory reform at the Federal level. Unfortunately, most of the regulations that impact home builders are at the state and local level. For instance, new home lot fees that are used for anything from environmental remediation, roads, public employee pensions as well as local education costs can vary greatly by state and locality. A new home lot fee is just over $2,500 in Houston but averages over $70,000 in San Francisco. Perhaps something to remember the next time Nancy Pelosi takes the podium and rails against “wealth inequality” or “affordable housing”.

The industry might also be marginal beneficiaries from regulatory reform at the Federal level. Unfortunately, most of the regulations that impact home builders are at the state and local level. For instance, new home lot fees that are used for anything from environmental remediation, roads, public employee pensions as well as local education costs can vary greatly by state and locality. A new home lot fee is just over $2,500 in Houston but averages over $70,000 in San Francisco. Perhaps something to remember the next time Nancy Pelosi takes the podium and rails against “wealth inequality” or “affordable housing”.

I continue to prefer the smaller home builders within my own portfolio. They have faster growth than the giants like Lennar (NYSE: LEN), which I also hold. They are also a bit cheaper than the biggest homebuilders as they don’t quite have the geographically diversity or the balance sheets of the largest players.

I continue to prefer the smaller home builders within my own portfolio. They have faster growth than the giants like Lennar (NYSE: LEN), which I also hold. They are also a bit cheaper than the biggest homebuilders as they don’t quite have the geographically diversity or the balance sheets of the largest players.

However, if the housing market continues to improve like I expect it to over the coming years, there is bound to be a pick-up in M&A activity in what is a very fragmented industry. Many of the smaller names in this scenario could easily be acquired for significant premiums.

I continue to like, profit and hold some of the smaller names I have profiled many times on these pages like Taylor Morrison (NASDAQ: TMHC) and William Lyons Homes (NYSE: WLH). However, my favorite small home builder continues to be LGI Homes (NASDAQ: LGIH) even though the stock is up more than 60% since I first recommended it at just under $20 a share. The company continues to beat quarterly earnings expectations as revenue growth continues to be impressive. The stock is also still cheap at under nine times this year’s consensus earnings forecast.

I continue to like, profit and hold some of the smaller names I have profiled many times on these pages like Taylor Morrison (NASDAQ: TMHC) and William Lyons Homes (NYSE: WLH). However, my favorite small home builder continues to be LGI Homes (NASDAQ: LGIH) even though the stock is up more than 60% since I first recommended it at just under $20 a share. The company continues to beat quarterly earnings expectations as revenue growth continues to be impressive. The stock is also still cheap at under nine times this year’s consensus earnings forecast.

1 Stock to Profit 285% or More from President Trump’s Biggest Campaign Promise

Only months into taking office President Trump has shown America that he is a man of action. The biggest campaign promise that Trump made was his $1 trillion infrastructure plan. Investors stand to make upwards of 285% gains with my favorite construction stock that can almost triple in size with the coming infrastructure bonanza. Find out all the details Bret Jensen’s new report “The One Stock You Want to Own to Cash in on Trump’s $1 Trillion Infrastructure Boom”.

Positions: Long LEN, LGIH, TMHC, and WLH

Category: Stocks