Is The AI Build-Out Causing An Energy Bubble?

A recent Wall Street Journal article, “The Frothiest AI Bubble Is in Energy Stocks,” highlighted the fact that investors are looking for any way to invest in the artificial intelligence boom.

It is becoming increasingly apparent that AI will need massive data centers that require enormous amounts of electric power. The U.S. power grid is transitioning from low growth, driven by calls for power efficiency, to a phase in which massive new power production will need to be brought online. The WSJ article noted that investors are excited about the potential for small, modular nuclear reactors (SMRs). The promise of SMRs is low-cost, small-footprint, reliable nuclear power.

Most of the companies working on SMR technology are private; however, the article highlights a publicly traded SMR company, Oklo (OKLO). Additionally, you can find more here.

Oklo’s share price is up 792% year to date, yet the company has no revenue and is not expected to have any sales until 2028. I discussed this stock with my subscribers early in the year, when the price was in the $20s. Many are happy I did—at $171 per share, Oklo no longer feels like a fun gamble.

Oklo isn’t the only energy company that stands to profit from the AI boom. Bloom Energy (BE) is working on hydrogen fuel cells, which have been used to power spacecraft, to generate electricity for AI. The company has been promoting commercial fuel cell applications for some time.

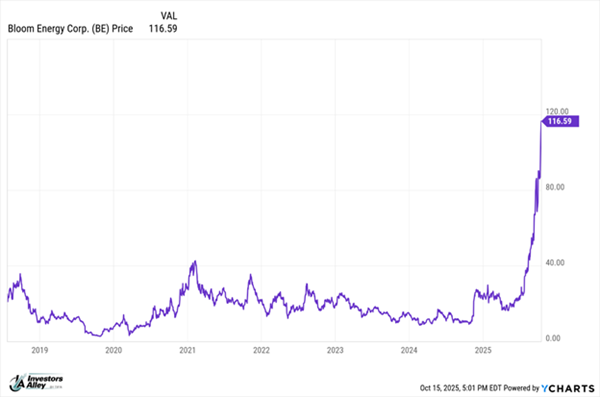

Bloom’s IPO was in 2018. The stock chart is a fun one:

Bloom Energy added $5.4 billion in market cap on October 13 after announcing a $5.4 billion investment from Brookfield Asset Management (BAM). BE trades for a 133 P/E. I would buy BAM, which is a stock a regularly follow.

Finally, if you want an under-the-radar AI energy stock, take a look at Liberty Energy (LBRT). The company was founded by Chris Wright, Secretary of Energy. Liberty Energy has developed small-footprint) natural gas generators (they fit on an 18-wheeler. The company inked a co-development agreement with OKLO to bring dual-source power to the datacenter world. The investing public hasn’t yet noticed.

This post originally appeared at Investors Alley.

Category: Stocks