How To Profit With Closed-End Funds

Investors are attracted to closed-end funds (CEFs) because of high yields and (often) stable monthly dividends. These types of dividends can provide stability in retirement. The challenge is not all CEF dividends are created equal.

So let’s take a look at what to look out for…

The CEF Connect website lists 423 CEFs that trade on the stock exchanges. Of that number, 329 pay monthly dividends. CEF fund sponsors include big-name money management firms such as Nuveen, BlackRock, Franklin Templeton, Pimco, and Invesco. Nuveen and BlackRock manage 95 CEFs between the two of them.

CEFs offer investment exposure to a wide range of investment categories. There are general stock funds and bond funds. Also, funds that focus on specific sectors such as utilities, MLPs, and municipal bonds. You can also find funds that apply specific investment strategies. One example is the Nuveen Credit Strategies Income Fund (JQC), which invests at least 80% of managed assets in loans or securities senior to its common equity in the issuing company’s capital structure.

I hope this data makes it clear that you need to be willing to do a lot of research to pick CEFs that meet your investment criteria and goals. And today, I want to highlight one CEF factor you must check while you’re doing that research.

Most CEFs employ what is called a managed dividend policy. The fund managers estimate the income or gains the fund will earn and set a monthly dividend rate based on those estimates. Many CEFs have paid the same monthly dividend for years; however, if the fund does not generate enough earnings to cover the scheduled dividend, a portion of the dividends paid to investors will be classified as return of capital (ROC). This means the investors are getting paid their own principal and not actually earning the published yield.

ROC answers how a bond CEF can pay a 12% yield when its bonds pay around 6%. In reality, half of the dividend payments are a return of investor principal.

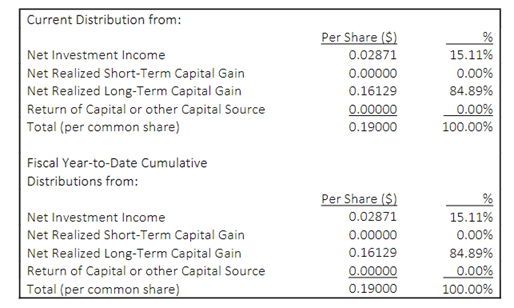

Fortunately, each month, every CEF sends a Section 19(a) notice showing the sources of the dividends paid for the month. The Section 19(a) notice for the Reaves Utility Income Trust (UTG) recently hit my inbox, so I am using that fund’s dividend data as an example. UTG pays a $0.19 per share monthly dividend and yields 8.5%.

Notice that a portion of the UTG dividend comes from net realized gains. This is not uncommon for CEFs invested in stocks. I regularly talk to the Reaves fund managers, who tell me that there are enough unrealized gains in the portfolio to support the dividend forever.

Of greater importance is the $0.00 return of capital. UTG has been around for almost 20 years, has steadily increased the dividend, and has never paid ROC. Currently, this fund is the only CEF in my Dividend Hunter recommended portfolio.

If you are looking at a CEF for your portfolio, the first check should be whether the fund pays ROC in its dividends. If it does, look for a different fund.

This post originally appeared at Investors Alley.

Category: ETFs