5 Laws Of Human Stupidity

We see stupidity while driving. People discussing religion or politics also get labeled as stupid if we don’t agree with them.

In personal finance we have the so-called “smart money” crowd. The phrase usually applies to high net worth investors and institutions. Somehow these people are considered “smart” by default. It can also mean everyone outside the “smart crowd” is stupid.

The mistake made is that smart money is more intelligent (less stupid?) than people not considered so smart. History is filled with instances where this is not true.

Rather than define “smart”, we need to define what it means to be stupid first. Warren Buffett, considered by many to be the greatest investor of all time, talked about avoiding the stupid mistakes, not about being smart*. Avoiding the big loss, the obvious bad investments, is a better way to outperform the averages than shooting for the moon. There is a clue in this advice for those wishing to attain wealth and keep it.

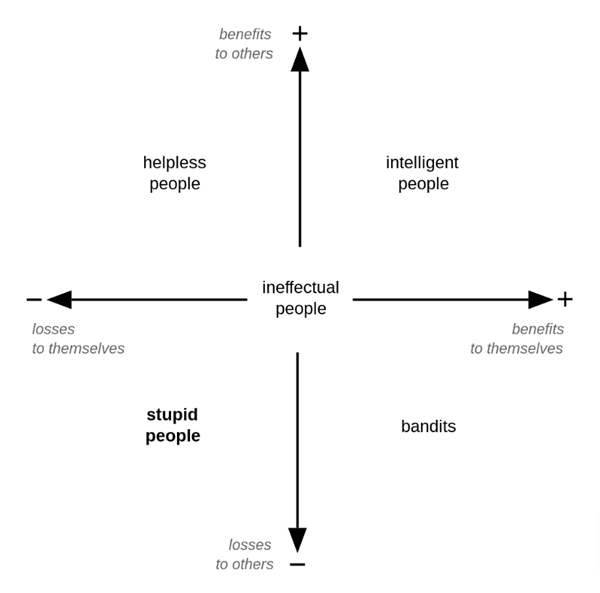

Lucky for us, stupidity has already been defined. Carlo M. Cipolla wrote The Basic Laws of Human Stupidity in 1976. Not only did Cipolla give us a definition for stupidity, he grouped people into four categories and showed how each category interacted with each other. Understanding these interaction can protect your wealth and even grow it.

The 4 Categories of People

Cipolla listed four categories of people:

- The Helpless

- The Intelligent

- The Bandits

- The Stupid

The most dangerous group is the stupid. Cipolla warns stupid people are more dangerous than the Mafia, military, or even communism.

Since stupid people are so dangerous, we need to understand what a stupid person is.

The 5 Laws of Human Stupidity

We will define stupid people first. The other categories will be defined as we show their interactions with other people.

According to Cipolla, there are five fundamental laws of stupidity:

- Everyone underestimates the number of stupid people in circulation.

- The probability a person is stupid is independent of other characteristics. An individual’s profession, education, level of wealth, and more, do not determine if a person is stupid. The stupid can come from any demographic, profession, or level of wealth.

- A stupid person causes a loss for other people while personally deriving no gain and may even incur a loss themself. (This is the most important of the laws as it defines what a stupid person is.)

- Non-stupid people always underestimate the damaging power of stupid people and that dealing with stupid people always turns out to be a costly mistake.

- The stupid person is the most dangerous type of person, even more dangerous than a bandit.

4 Factors of Human Behavior

Cipolla outlines four factors of human behavior. A person can:

- Cause benefits to others,

- benefits to themselves,

- losses to others, or

- losses to themselves.

Intelligent people provide benefits to society while leveraging these benefits into personal gains.

Bandits only consider their self-interests, even when at the expense of society.

Stupid people take actions that harm other people while gaining nothing from their actions and may even face injury.

Helpless people contribute to society but are taken advantage of.

Because this is so important, we need absolute clarity. Assume you have five friends. If one friend helps another while benefitting himself, we say he is intelligent. If another friend benefits himself while another person takes a loss, we say he is a bandit. A friend helping others while suffering a personal loss is called helpless. While the friend causing a loss for another, also takes a loss, is considered stupid. (See chart above.)

The fifth friend is in the middle causes negligible gain or loss for self or others. We call this friend ineffectual.

Interactions Between Groups

As we can see by the diagram, certain types of people tend to attract. Bandits are attracted to the helpless due to the willingness of the helpless to accept loss so another can gain.

Intelligent people tend toward win/win solutions. This is why helpless people should support and work with intelligent people.

Bandits are in it for themselves. Intelligent and helpless people try to stop them to varying degrees of success.

Stupid people don’t care. They don’t care who loses. There is no obvious reason for their antisocial behavior. Everyone finds stupid people a source of frustration. Even other stupid people! (Usually.) The only exception is groups, such as those subscribing to certain conspiracy theories, working together to frustrate all others outside the group.

The worst part about stupid people, according to Cipolla, is that they are stupid by nature. You will not win the debate, as a story I share in a moment will point out. Cipolla warns that the amount of damage stupid people can inflict is determined by how much stupidity they inherit coupled with there position of power within society.

Winning the Battle, Losing the War

Recently I had an interaction with a person some might consider stupid based on our discussion above. My daughter invited friends and family to a BBQ at my farm.

One of her co-workers asked a litany of tax questions of me. As everyone was leaving he kept the conversation going. At one point he mentioned we never went to the moon.

At first I indicated my incredulity. Yes, we went to the moon! I even mentioned some evidence.

But he was undeterred. He made it clear there is compelling evidence the moon landings never happened.

It became clear he also had a strong political belief that I will identify as “on the right.”

After a few minutes of frustrating discussion, I said, “You know, you convinced me. I think you are right, after all. We never went to the moon.” (Should have seen the look on his face.)

I continued, “You know what else I realized? Do you know what political party was in the White House for every last moon landing? The party on the right. As soon as the other party took over the White House there was not a single moon landing. And since they are willing to tell such a massive lie while in power, and I assume to keep power, I will never vote for those lying scoundrels ever again!” I then put out my hand to shake, saying, “Welcome to the left.” (I said the party name but we don’t want search engines punishing this blog over saying the R or D word.)

You should have seen his face. It was hard to keep from laughing.

As you can see, this individual gained nothing by denying the moon landings, but America is diminished because it takes away a great accomplishment of the nation. It brings all Americans down for no personal gain. This is the definition of stupid, as outlined by Cipolla.

Stupidity in Personal Finance

The level of stupid often is nothing more than an annoyance. When it comes to money, however, it can become costly.

Remember, the stupid don’t care if they lose, just as long as they can cause injury to another. They may be fully aware an investment is bad. They may also have money in the investment and are too stupid to get out due the sunk cost fallacy. They will still encourage you to invest anyway. (The bandit will sell you his losing position to stem the losses while the intelligent will cut losses and recommend you stay away. Only the stupid play the lose/lose card.)

Over the years, I have seen this pattern play out many times. A client shows me an offer. They want my opinion (not really). Usually they already bought or want me to give the nod (need someone to blame) before they buy. Can you see how they are acting stupid? Can you see how easily I could slip into helpless behavior?

Personal finance is not that hard. Controlling emotions is! If people were able to be objective when spending and investing 99% of money problems would not exist.

Worse, we are not solely our worst enemy. Friends, family, and acquaintances contribute.

Warren Buffett has said often that he invests in companies, not pieces of paper that jiggle around in price. He spends zero time examining charts of past prices or macro-economic issues. He buys good companies he understands at a good price.

For most of us, that means we sink our retirement and savings into index funds. (We don’t understand businesses well enough to buy parts of these individual businesses.) Sorry, it is that simple. (Does that make me intelligent if I help you while also benefitting?) Telling you anything different would make me stupid.

Yes, there are other factors. Paying off debt is a big one. Warren Buffett also mentions often his lack of desire to use leverage (borrowed money). Dave Ramsey made a career out of telling people to get out of debt. And the vast majority of the very wealthy (in financial terms) have little to no debt. When the wealthy do borrow funds it is to invest and/or to reduce taxes.

People will tell you how wrong index investing is. They also might think we never went to the moon. Or that high-risk investments are a good idea for anything more than a few percentage points of your portfolio.

Cipolla thinks stupid people will always be stupid. Watching YouTube videos of people interviewed at political rallies can show this clearly when the interviewed admits they are wrong but sticks with their position anyway.

I am not qualified to tell you who to vote for. That is your choice. I am qualified to inform you of good tax strategies and how to build your net worth. Not only have I done this personally, but helped others do the same. That is why you need to read this blog often (win/win).

My gut tells me Cipolla is wrong about only one thing. Stupid is not locked in. We all have moments of stupidity. We might be intelligent in all areas of life, save one, where we sink to levels of industrial strength stupidity.

Yet, we learn and grow. Stupid is not forever. At least it does not have to be, in my humble opinion.

* Warren Buffett quote from a shareholder meeting: “You don’t have to do exceptional things to get exceptional results.”

This post originally appeared at The Wealthy Accountant.

Category: Personal Finance