“What’s The Safest Dividend? Here’s How To Find It”

There is an old investment saying that the safest dividend is the one that was just increased. With the stock market currently in a correction, looking for stocks that have fallen sharply yet pay stable and growing dividends would be a good place to look for stocks that will benefit the most when the markets recover.

Publicly traded hedge fund companies have been hit particularly hard during the current market downturn. Here are the returns from recent highs of three hedge fund companies listed by Investopedia.

- Blackstone Group (BX) is down 30.3% from its 52-week high.

- KKR & Co. (KKR) down 34.8%.

- Apollo Global Management (APO) down 31.7%.

KKR and Apollo Global Management do not pay much in the way of dividends, and Blackstone has a variable dividend payout strategy.

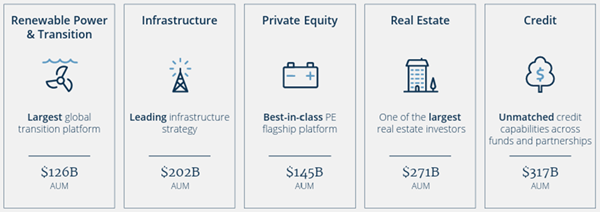

Brookfield Asset Management (BAM) is an asset manager with a $75 billion market cap and $1 trillion of assets under management. Here is a breakdown of BAM’s investment categories.

Like its peers, the BAM share price is down 25.2% from the recent high.

What appeals to me is that BAM increased its dividend by 15% on February 12. The shares currently yield 3.72%. The dividend was increased by 18% one year ago, in February 2024. This is a company confident about its growth and rewards investors accordingly.

Brookfield Asset Management is an attractive stock at $60 per share. Now 25% cheaper at $45, there seems to be little chance for much further for the price to go down and a strong opportunity for 30% or more in gains from here.

This post originally appeared at Investors Alley.

Category: Dividend Stocks