Unlock The Power Of Passive Income For Financial Freedom

The allure of passive income — imagine an image of cash flowing effortlessly into your account as you relax on a sun-drenched beach — this image has captivated many with dreams of financial freedom. Since founding NetPicks in 1996, I’ve learned firsthand that the reality of running a business is anything but passive.

I think it’s important to clear up some common misconceptions: passive income isn’t just a fantasy for the wealthy or the lucky, nor does it require being a financial expert.

In recent years, I’ve discovered the wisdom of diversifying income streams (multiple streams of income) and blending active investments with more hands-off, cash-flowing methods. However, on the road to establishing these streams, I had many questions and challenges, especially concerning how to achieve this balance without adding more stress and pressure to my day.

Let’s explore the truth behind these myths, and give you a more realistic understanding of passive income and set you up for success.

Financial Freedom Without More Work

I wasn’t interested in more work, nor did I have the time. I also wanted my money working for me – not vice versa.

If I was traveling the world, I wanted to know that cash flow was coming in every month passively, reliably like clockwork.

In fact, over the last 12 months, I’ve:

- Visited 24 countries.

- Taken five cruises and sailed 17,973 nautical miles without great internet and had zero work to do on these passive investments

- Traveled 214,321 miles by air

- Spent 108 nights in Airbnb, 122 nights in hotels, 54 nights on a cruise ship, 20 nights in our overseas home, and even one night on a plane.

Yet, at every mile, the passive income streams I set up one time continue to generate cash flow.

I’m living proof you can do this. And you don’t have to travel the world to enjoy these benefits. Whatever brings you happiness is all that matters.

Myths About Passive Income Investing

Before you trade your spreadsheets for flip-flops, let’s put to rest some myths that might cloud your financial forecast.

Myth 1: Passive Income Is Only for Investing Pros

Fact: Being a financial genius isn’t a prerequisite for passive income.

Covered call ETFs offer a low-maintenance way to earn steady dividends while hedging against market downturns. And forget million-dollar mansions – fractional real estate lets you own slices of single-family homes, vacation rentals, or even commercial properties, all without the hassle of full ownership. At the same time, they generate monthly income that can be transferred directly to your bank account.

Myth 2: You Need a Hefty Bank Account to Start

Fact: Many opportunities start at $50 and up. The secret? Start today.

Fractional business ownership lets you invest in thriving companies with minimal capital requirements. Forget about six or seven-figure high-risk investments. Imagine owning a piece of an already profitable, cash-flowing business that sends you money quarterly. Even when you’re sipping the morning latte, these businesses are hard at work for you. Your work? Just decide where to deposit the cash flow and what to do next.

Myth 3: Passive Income Means Months of Setup Hell

Fact: You can sleep late, wear your bathrobe, and rely on cutting-edge trading platforms and technology to enter your investment in seconds.

For most of my passive cash-flowing investments, I’ve decided to invest in minutes, not hours or weeks. Fractional real estate, including single-family and vacation homes, where investments can start small, can be completed in a few clicks.

Myth 4: Passive Income Is a Risky Rollercoaster

Fact: Nothing is perfect so we always focus on assets that have legitimate value and avoid risky speculation.

Different passive income strategies have varying risk profiles. Our Passive Income Accelerator course teaches you how to combine market timing and high-yield dividends to minimize risk. And you can get more adventurous once you are well diversified. After all, capital requirements are low, the time needed is minimal, and many choices are available to you right now.

Myth 5: Passive Income Won’t Make a Dent in Your Wallet

Fact: Small streams eventually fill the oceans, especially on autopilot.

Even small amounts of cash flow can snowball over time through the power of compounding. I currently bring in a six-figure passive income, but that didn’t happen overnight. My secret? Just getting started, not procrastinating, and avoiding the latest get-rich-quick opportunities clogging your inbox.

Owning a small slice of some of the largest companies in the world and using creative strategies can let you benefit from their hyper-growth and provide some surprising yields that blow away what you’re used to experiencing: I’m talking 5x to 10x as much as typical dividends.

Toss the myths and embrace the truth: passive income is attainable, affordable, and impactful.

Don’t let outdated beliefs hold you back from building a future where your money works for you, not the other way around.

Ditch The Spreadsheets. Embrace The Hammock.

The Passive Income Accelerator course is your roadmap to building multiple passive income streams and ultimately achieving your financial goals.

Learn the proven strategies, avoid costly mistakes, and join a community of like-minded individuals on the path to passive income freedom.

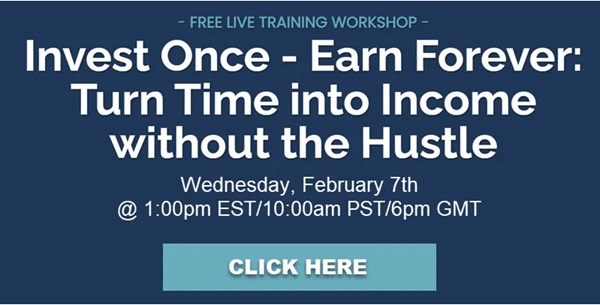

I’ll be holding a live training where I share exactly what I’ve done to achieve passive income freedom, and you can join me here to learn more:

Let’s get you started on the path of passive income freedom today.

This post originally appeared at NetPicks.

Category: Personal Finance