Tiny Stocks, Tremendous Yields: 5 Small Caps Yielding Up To 13.8%

Small-cap stocks are on sale. We can buy select names for just 8.8 times earnings and 83% of book value.

Large cap stocks rarely sell this cheap. That is the problem with popularity! Which is why we’re looking small but thinking big, eyeing payouts between 7.3% and 13.8%.

(Those dividends are no typos. The beauty of being nimble individual investors means we can fish in these small but potentially lucrative ponds.)

Now small cap stocks aren’t always this cheap. Traditionally, smaller firms trade at a premium to their large-cap counterparts given their outsized upside potential. But today, small caps are less expensive by just about every valuation measure.

Cheap for a reason? Let’s explore five of them dishing dividends that average a terrific 10.7%.

Buckle (BKE)

Dividend Yield: 10.3%

Buckle (BKE) is a fashion retailer offering mid- to higher-end clothes, accessories and footwear across more than 440 stores in 42 states.

And as a stock, it’s downright strange.

It’s a brick-and-mortar retail stock that has more than tripled in the past five years. It’s a fashion stock with low volatility. And it’s a retail stock that has comfortably paid a generous yield for years.

While many retailers were permanently crippled by COVID, Buckle was shot out of a cannon. The company has enjoyed an explosion in profits that sent shares to all-time highs near the start of 2024.

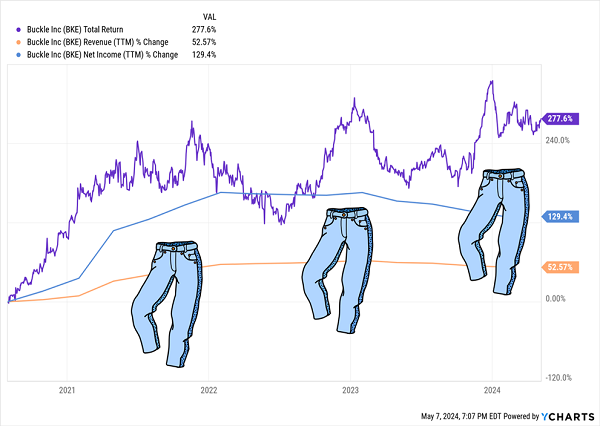

Buckle: A Rare Feel-Good Retail Story

I’ve said for a while that the rampant growth story is likely over, and the past few quarters of financials seem to reflect that. Most recently, BKE reported a 7% decline in revenues (and 8% drop in comparable-store sales) for the fiscal year ended February 2024. Profits were off 14%.

But I wouldn’t bet against Buckle, either. For one, while profits are projected to decline again this year, the bottom line is actually expected to rebound by mid-single-digits in fiscal 2026. And most of the anticipated weakness is largely baked in, with shares trading at less than 10 times earnings estimates.

The dividend should set a decent floor, too. For years, BKE has been locked into a 35-cent quarterly payout that currently yields a respectable 3.7%. But management, fully acknowledging the fickle nature of its business, has avoided increases that it might have to ratchet back down the road. Instead, it has supplemented the regulars with a fat annual special—this January’s payout of $2.50 per share comes out to an additional 6.6%.

Can we expect to get 10% out of Buckle in perpetuity? Probably not. But it’s a responsible dividend program that will reward shareholders in good years.

DHT Holdings (DHT)

Dividend Yield: 8.5%

DHT Holdings (DHT) is a crude oil tanker owner and operator with a fleet of 24 Very Large Crude Carriers, or VLCCs. These are the second-largest class of oil tanker at between 200,000 and 320,000 tons deadweight (DWT)—they sit below only the also-not-cleverly-named Ultra Large Crude Carrier (ULCC).

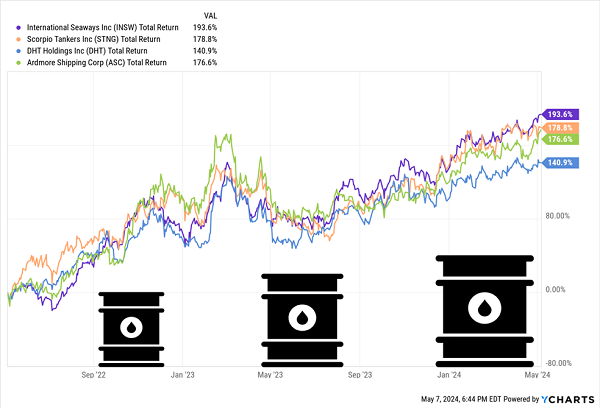

Broadly speaking, tanker stocks have soared over the past two years thanks to a confluence of factors. For one, the world’s demand for oil has rebounded post-COVID. OPEC oil production cuts have pinched supply. And the Russian war against Ukraine caused many nations to source their oil from outside of Russia, which resulted in new, longer routes and more demand for tankers.

DHT Has Trailed Its Rivals But Has Still More Than Doubled in 2 Years

That total return has been aided by a plump 8%-plus yield. But I want to point out two important asterisks:

- That dividend is variable based on profits. DHT’s trailing 12-month dividends come to 99 cents per share. The prior 12 months? Less than half of that, at 48 cents per share.

- Those dividends have accounted for 100% of diluted earnings per share (EPS) over that time.

We might assume that DHT is undervalued given that it hasn’t enjoyed the same lift as its peers. And in at least one way, it is—shares trade for less than 9 times forward earnings estimates, which is certainly cheap in a bubble. But that’s actually pricier than most of its competitors.

DHT also trades at a premium to net asset value (NAV) estimates, compared to a 10%-15% discount for most of the rest of the industry.

Two Harbors Investment (TWO)

Dividend Yield: 13.8%

Two Harbors Investment (TWO) is a mortgage REIT (mREIT) that deals in mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBSs) and other financial assets. It does so through the RoundPoint Mortgage Servicing platform, which Two Harbors acquired in late 2023.

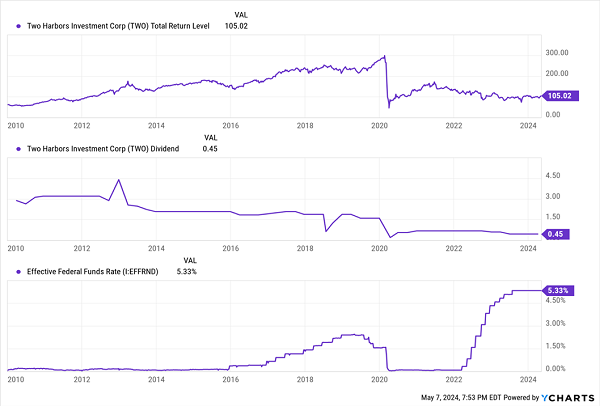

The basic mortgage REIT business goes like this: An mREIT buys mortgage loans and collects the interest. They make money by borrowing “short” (assuming short-term rates are lower) and lending “long” (if long-term rates are, as they tend to be, higher). It’s a great model when long-term rates are steady or, better yet, declining. A drop in long-term rates makes existing mortgages more valuable because newer loans pay less.

But if long-term rates are rising, like they have over the past couple years, mREITs get killed.

Pundits were largely bullish on mREITs (like TWO) coming into 2024 because everyone expected the Federal Reserve to finally hit the brakes and send the rate train into reverse. That hasn’t come to pass, though, and the time table for rate reductions keeps getting pushed back, putting a continued pinch on TWO and its peers.

Will an eventual Fed rate cut get TWO shares back on their feet? Well, it couldn’t hurt. But investors should note that while Two Harbors outperformed the S&P 500 on a total-return basis in the decade preceding COVID, the dividend still shrank considerably—even during periods when rates were more accommodating.

Rain or Shine, TWO’s Dividend Kept Dwindling

To its credit, though, TWO’s current dividend appears well-covered. And TWO recently reported a 3% increase in book value, widening its discount to 83% of book.

But like most other mREITs, TWO’s investment thesis isn’t its own—it’s driven by the Fed, for better or worse.

CION Investment (CION)

Dividend Yield: 13.7%

Business development companies (BDCs) are one of my favorite high-yield assets. These private equity-esque companies provide financing to dozens if not hundreds of private small- and mid-sized businesses. Unlike PE, though, BDCs are publicly traded and available to your average Joe. And we don’t need a million bucks or more to join in—we can buy as little as one share, typically 10 to 20 bucks.

CION Investment (CION) is an externally managed BDC that typically invests around $30 million in companies with $25 million to $75 million in EBITDA. This capital can be used for any number of reasons—growth, acquisitions, refinancing, market expansion, and so on.

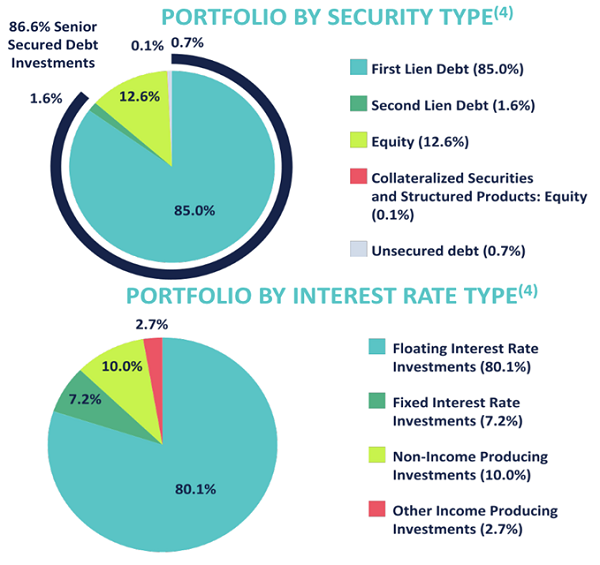

Currently, CION has roughly $2 billion in assets invested across 111 portfolio companies. Most of those investments are in first-lien senior secured debt (85%), with another 13% in equity, and the rest peppered across second-lien and unsecured debt, as well as collateralized securities and other products. A good 80% of the portfolio is floating-rate in nature.

While its companies are spread out across a few dozen industries, it does have some heft in business services (15% of the portfolio’s fair value) and healthcare and pharmaceuticals (13%).

CION is a young BDC that direct-listed in October 2021, but since then, it has showed investors the cash. It pays a large 34-cent quarterly dividend that yields about 11.6%. But it also has paid a small special dividend over the past couple of years, and in 2023, it paid a pair of modest supplementals. Add up all of its dividends across the past 12 months, and you get a yield of nearly 14%.

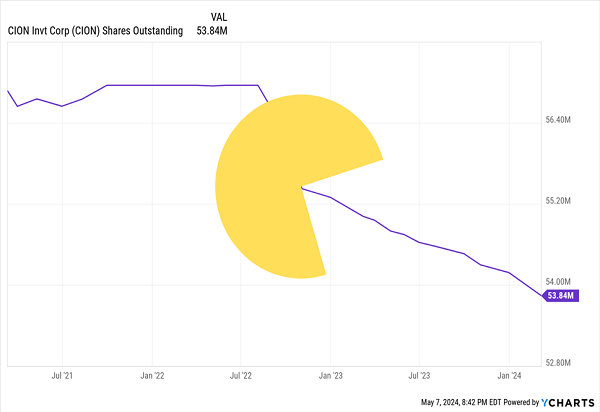

CION Has Been Gobbling Up Shares, Too

Wall Street is still trying to figure this BDC out. When I discussed CION in March, it traded at just 0.68 times NAV; a couple months and another 9% in gains later, and it’s still at a wide 0.72x discount to NAV.

Royce Value Trust (RVT)

Distribution Rate: 7.3%

Royce Value Trust (RVT), as the name suggests, isn’t a single stock—it’s actually a closed-end fund (CEF). But at less than $2 billion in assets under management, it still sits within small-cap territory.

And it holds small caps to boot.

Royce Value Trust is actually the first small-cap CEF, going live all the way back in 1986. It invests in small caps, but through a value lens, buying up shares of small firms that trade “at what Royce believes are attractive valuations.” Currently, that means industrials, financials, and strangely enough, technology.

Remember: Unlike mutual funds and ETFs, CEFs rarely trade at their net asset value—in RVT’s case, the CEF has long traded at a double-digit discount. But right now, it’s truly on sale, as its 13% discount to NAV is even steeper than its five-year average 10% markdown.

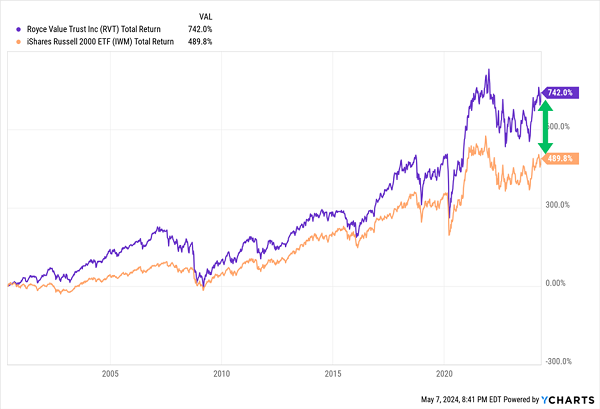

That’s a sizable deal on a fund that has battered its benchmark (the Russell 2000) over the long run—while delivering a fat 7%-plus yield with a small-cap portfolio!

The Russell Doesn’t Hold a Candle to Royce

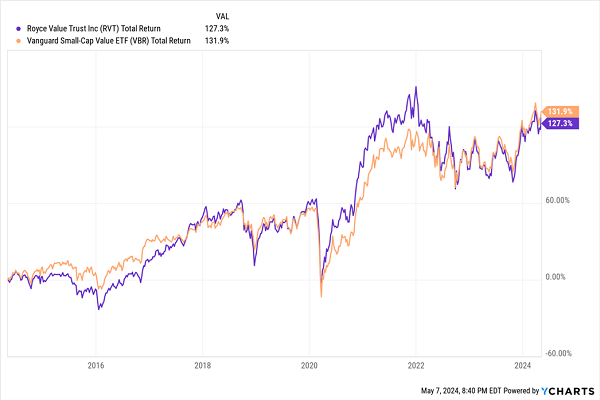

Just be aware that, against value small-cap strategies, which are more in line with what RVT is aiming for, Royce Value Trust has delivered more mixed results.

This Closer Comparison Is a Closer Race

Give Me 5 Minutes, And I’ll 5X Your Retirement Income

When it comes to can’t-miss retirement cash machines that we want to hold for decades, we need stocks and funds that stand on their own.

And if you’re thinking “No way those kinds of stocks exist,” think again. Because these are exactly the kinds of names I hold in my “Perfect Income” portfolio.

We don’t chase trends. We don’t time the market. In my “Perfect Income” portfolio, we simply target high-yield investments (roughly 5x the S&P!) and hold on to them, no matter what the Fed, Congress or the rest of the world throws their way.

In addition to having high-single-digit and even double-digit yields, every single holding must check off several crucial boxes:

- They DO pay consistently, predictably and reliably.

- They DO survive—and even thrive—in market crashes.

- They DO deliver double-digit returns, with safe, secure investments.

- They DO require minimal management time—just a few minutes every month!

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks