Shopping Around Gives You A 5% Dividend Yield

Welcome to 2026, everyone!

The holidays are over.

Like many of you, I’m glad I don’t have to shop for more presents.

But I never tire of shopping for new dividend stocks.

The following company is in real estate.

In particular, it owns open-air shopping centers around the United States.

Sorry, I know you’re tired of shopping.

But Kite Realty Group (ticker: KRG) needs to be on your radar.

Kite is a REIT (Real Estate Investment Trust) operating 180 open-air shopping centers all over the US.

These shopping centers are anchored by grocery stores, which means more foot traffic to Kite’s tenants.

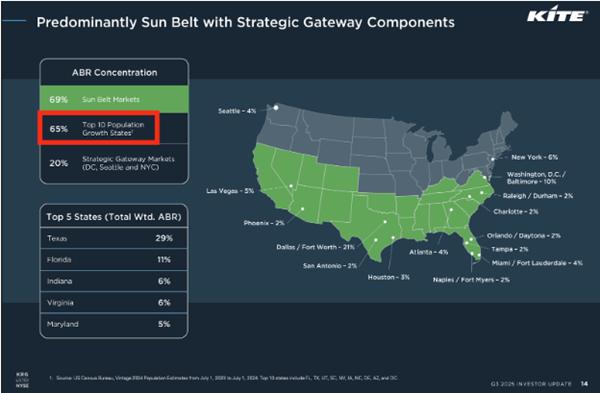

Geographically, Kite focuses most of its real estate in the Sun Belt region.

The part highlighted in red gets me really excited about Kite.

65% of its properties are located in the top 10 states by population growth.

Higher population growth means more people shopping at Kite’s tenants, which helps its dividend.

And Kite’s dividend is awesome.

Its current dividend yield is around 5%, which puts Kite right around the REIT average.

But its dividend growth really stands out.

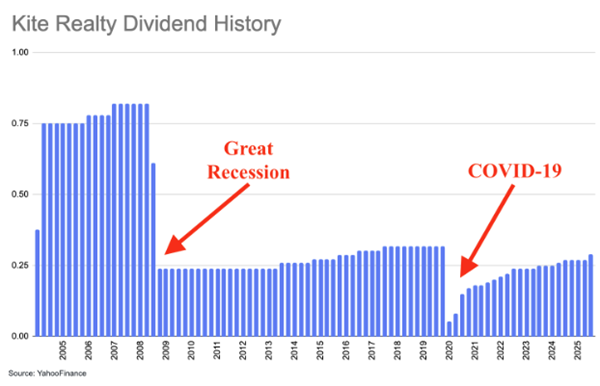

The above chart looks terrible!

Kite Realty has cut its dividend by huge amounts twice since it started making payments in 2004.

The first major cut happened during the Great Recession in 2009.

Cut number 2 was because of the COVID-19 pandemic.

Why are you recommending a dividend stock with a history of such bad dividend cuts?

I promise I’ll get there in a minute.

Kite stabilized its dividend payment in 2023.

Since then, Kite has averaged 6.5% dividend growth.

And Kite’s latest dividend increase, up to $0.29 per share, is 7.5% higher than its last payment.

REITs usually average around 3% growth, so Kite is growing its dividend much faster than its peers.

If you want Kite’s higher dividend, you better act fast.

You need to own Kite by January 8th (Thursday) to get the higher payment.

Let’s talk about the dividend cuts.

The Great Recession and COVID-19 pandemic were terrible for stocks.

Many companies drastically cut their dividends to keep their doors open.

Kite was no exception.

But management has learned from the experience and is working on shoring up its balance sheet.

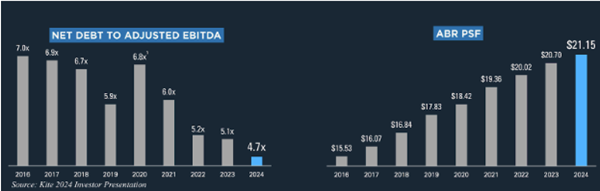

Kite has significantly reduced its net-debt-to-adjusted-EBITDA ratio over the past few years.

A lower net-debt-to-EBITDA-ratio means Kite has more income to cover its debt.

And the ABR PSF chart on the right is important as well.

ABR PSF is annualized base rent per square foot.

It measures how much rental income Kite gets per square foot of its property.

The ABR PSF rising shows Kite is more efficient in collecting money for the space it owns.

Could Kite have another dividend cut during the next crisis? Sure.

But Kite has done a really good job trying to make sure it doesn’t happen again.

What real estate stocks do you own?

Michael Jennings, Editor

This post originally appeared at Dividend Stocks Research.

Category: Real Estate, Stocks