The SEC Just Approved 11 Exciting New Ways To Lose Money

Much of the financial world has been waiting (for almost a decade) for the SEC to approve spot Bitcoin ETFs. On January 10, it finally happened.

And now we have 11 exciting new ways to lose a bunch of money. Let me explain…

A spot Bitcoin owns a portfolio of Bitcoins directly, and ETF investors buy shares of the portfolio. The structure is the same as the SPDR Gold Shares ETF (GLD), which owns physical gold, and GLD investors own shares of the GLD portfolio. GLD shares are backed by physical gold. Bitcoin holdings, not futures contracts, back the new breed of Bitcoin ETF shares.

A lot of financial services companies have jumped on the Bitcoin ETF wagon. Here is the list published on January 12 by ETF Trends:

Grayscale got the big jump on the competition because it is one of the leading crypto asset managers.

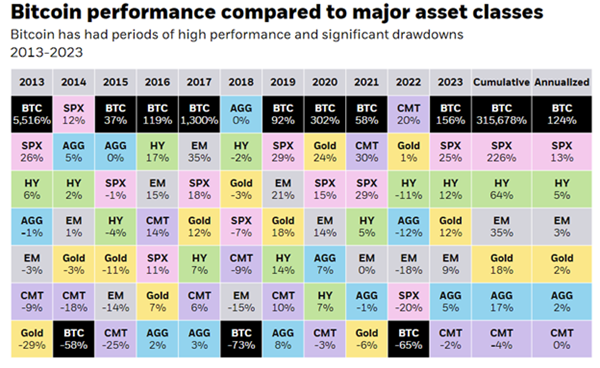

For a deeper dive, I looked at the iShares Bitcoin Trust (IBIT). The fund literature included this very interesting table:

It is fair to say that Bitcoin has caught the attention of speculative investors. Be aware that if an investment loses 75% of its value, it must gain 400% to reach breakeven.

The IBIT prospectus provides this description:

The Trust is intended to provide a way for Shareholders to obtain exposure to Bitcoin by investing in the Shares rather than by acquiring, holding and trading Bitcoin directly on a peer-to-peer or other basis or via a digital asset platform. An investment in Shares of the Trust is not the same as an investment directly in Bitcoin on a peer-to-peer or other basis or via a digital asset platform.

With one Bitcoin priced at over $40,000, the ETF shares make it easier for small investors. The funds have current share prices ranging from $12.00 to $50.00. Most have discounted their expense ratios until they hit a certain level of assets, typically $1 billion.

In the runup to the ETF approvals, Bitcoin appreciated to as much as $49,000 per coin. Once the ETFs started trading, the coin dropped to less than $43,000. Bitcoin is highly volatile. Period.

I don’t recommend any type of Bitcoin investment. It is pure speculation and not investing. However, as these funds increase their assets, I may look at them for covered call options trading.

This post originally appeared at Investors Alley.

Category: crypto