Finally Better Than My Mattress: Safe Bond Funds

Last time we spoke about safe bond funds, I recommended an unconventional alternative: my mattress.

It was June 2022. Interest rates were rising, bond prices plummeting, and we contrarians were smartly sitting on sizeable cash positions.

Thoughtful reader William wrote in asking about using short-term bond funds as “cash equivalents.” After all, wouldn’t some yield be better than no yield?

No. Short-term bond funds were no match for my mattress, which does not trade inversely with interest rates. Bond prices and interest rates are an inverse seesaw—when rates rise, bond prices fall and when rates fall, bonds rise.

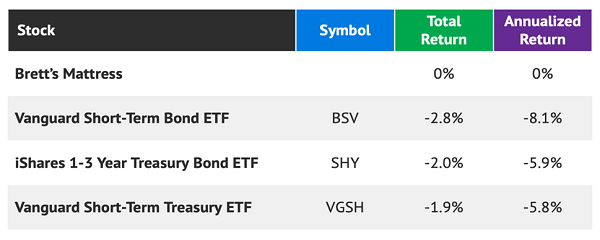

Plain ol’ cash outperformed the three safe bond funds we used as cautionary examples. Here’s how each “vehicle” performed in the four subsequent months:

The Safe Bond Funds Weren’t Really Safe

Remember there are only two drivers that determine any bond’s price direction:

- Duration risk: Higher future rates are bearish for bond prices. Rates up, prices down. Lower future rates are bullish. Rates down, prices up.

- Credit risk: What’s the chance that the bond issuer implodes and can’t pay us back in the future?

Credit risk is not a concern with these safe bond funds. Especially with iShares 1-3 Year Treasury Bond ETF (SHY) and Vanguard Short-Term Treasury ETF (VGSH) which feature US Treasuries. If Uncle Sam gets into a bind, he’ll just print more money!

Problem is, the “short term” feature of these funds doesn’t help when short-term rates are going up briskly. As they were in 2022.

Fortunately, we’re largely out of that rising rate mess. We survived the great bond bear market of 2022-23 by hiding in cash. Now, it’s time to play offense.

My favorite way to take advantage of this shift is via long-term bonds. The Federal Reserve is determined to leave short-term rates higher for as long as it takes to bring inflation down. Which means slowing the economy. Which eventually brings long rates even lower from here.

This means price upside for long-dated bonds and bond funds. We discussed potential plays—with some yielding a terrific 10%—in these pages last week.

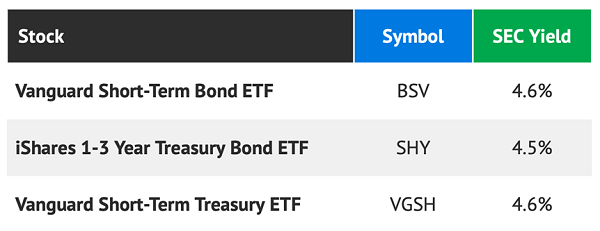

Short-term bonds should be fine too. The “duration risk” should be capped with the Fed largely done raising short-term rates. Which means we can move Vanguard Short-Term Bond ETF (BSV), SHY and VGSH back into “green light” mode. Income investors looking for a place to stash cash should do fine in these funds.

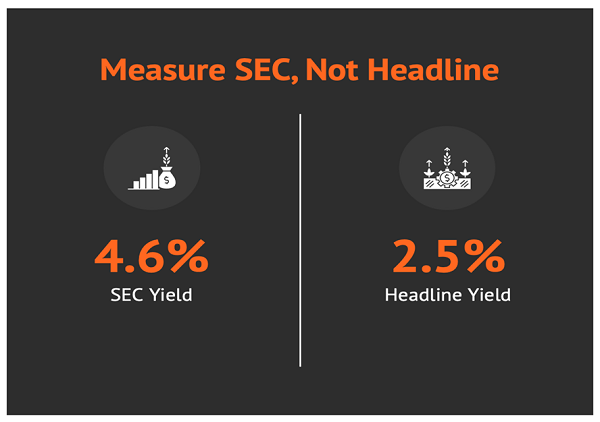

If you visit a vanilla financial website, it will likely tell you that BSV only yields 2.5%. BS. I’m quoting you the SEC Yield, which is what the pros use.

Always use SEC Yield when evaluating bond funds. This is the distribution stat developed by the Securities and Exchange Commission itself to support a truer yield measurement. The trailing twelve-month yield—which is lazily quoted—gets “stale” quickly. Things turn on a dime in Bondland!

SEC Yield reflects the interest the fund earned, minus expenses, over the past 30 days. It’s the best guide for us today and tomorrow, way better than the TTM payout. For bond yields, we want to know where we’ll go, not where we’ve been.

For a bit more yield, consider SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), which boasts a 5.2% SEC Yield. Please note that BIL is, by definition, near term. Which means when the Fed cuts rates, BIL will likewise trim its payout.

That said, it’s nice to have a reliable place to stash short-term cash. Last fall, our boy the “Bond God” Jeffrey Gundlach advised investors to not worry about then-rising rates. Instead:

Buying BIL to chill should work too. That said, Gundlach has since updated his advice to favor longer-duration bonds. He believes the economy is either heading into a recession or already in one, which will favor longer duration fixed income.

In our March edition of Contrarian Income Report, we discuss my favorite bond fund to buy now for price upside. I’d love to send you my latest research—unfortunately I’m showing that you don’t have an active subscription.

You can access my bond research immediately by subscribing to CIR on a risk-free basis. This is the perfect time to do so and take advantage of the big bond bull market that is unfolding.

This post originally appeared at Contrarian Outlook.

Category: Bonds