Really Rich REITs: 7 Massive Yields Up To 15%

Select real estate may be the income investing play for 2024. As I write, seven real estate investment trusts (REITs) are dishing dividends from 8.7% all the way up to 15.4%.

These REITs—and their ilk—are literally designed to deliver dividends. That’s how Congress wrote the rules when they legislated these real estate investments into existence back in 1960.

REITs avoid taxes at the corporate level. But in exchange, they need to pony up at least 90% of their taxable income and redistribute it to investors as dividends.

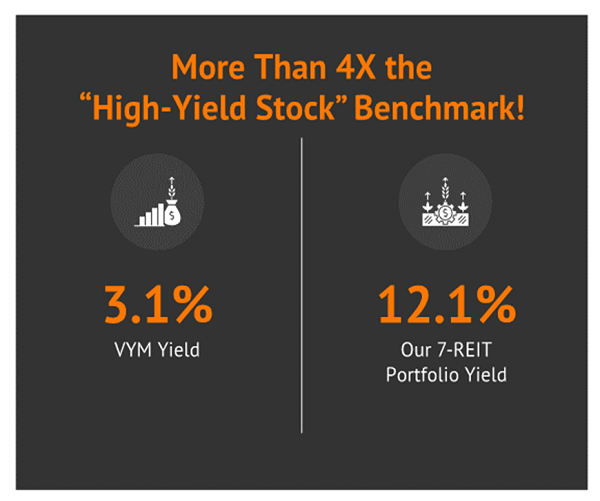

As a result, our average REIT yields somewhere around 2x to 3x the market. But we can do much better than simply “average.” The 7-pack of REITs we’ll review today pays 12.1%—or roughly 8x the S&P 500!

That level of income would allow us to retire on dividends alone. But we need to be careful.

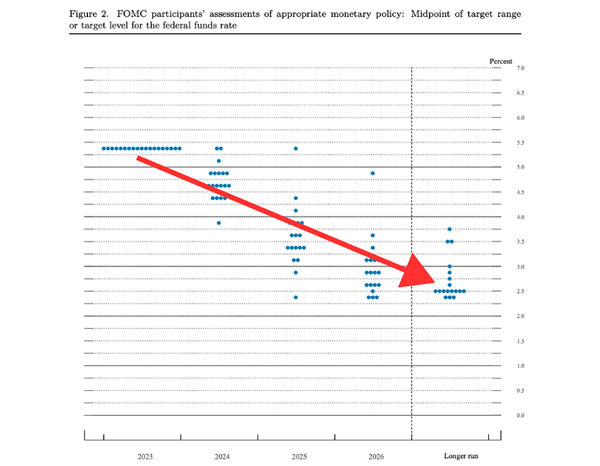

On the one hand, the Federal Reserve—whose hawkish rate policy has been going against REITs for years now—finally looks primed to take its boot off of real estate’s collective neck. The Fed not only paused at its most recent Federal Open Market Committee (FOMC) meeting, but indicated (via the “dot plot”) that we could see three rate cuts in 2024.

REITs trade like bonds. When rates rise, REITs drop. Which is why these stocks are so far down over the past two years. Rising rates have hurt REIT prices.

Now, however, it’s time for rates to “reverse skate” thanks to the Fed. That said, an economic slowdown isn’t ideal for all landlords. Be must be picky.

Let’s start with a pair of mortgage real estate investment trusts (mREITs), which rather than holding physical real estate, instead hold “paper”—typically securitized mortgages and other loans. mREITs represent some of the fattest dividends you’ll ever find, but you have to be particularly choosy in this space.

Armour Residential (ARR, 15.2% dividend yield) primarily invests in mortgage-backed securities (MBSs) issued or guaranteed by U.S. government-sponsored entities such as Freddie Mac, Fannie Mae or Ginnie Mae. Right now, 92% of the portfolio is invested in 30-year fixed-rate pooled mortgages, 5% is in agency commercial MBSs, and the rest is in “TBAs” (literally “to be announced,” which are contracts to buy or sell MBSs at some future date).

In general, the mREIT business is an exceedingly difficult one, but the past few years have done Armour and other REITs no favors. That’s because rising mortgage rates mean new loans pay more, thus shrinking the value of existing loans. But perhaps you could be optimistic about Armour with the Fed expected to pursue rate cuts in 2024—an accommodating environment for mREITs.

But perhaps not.

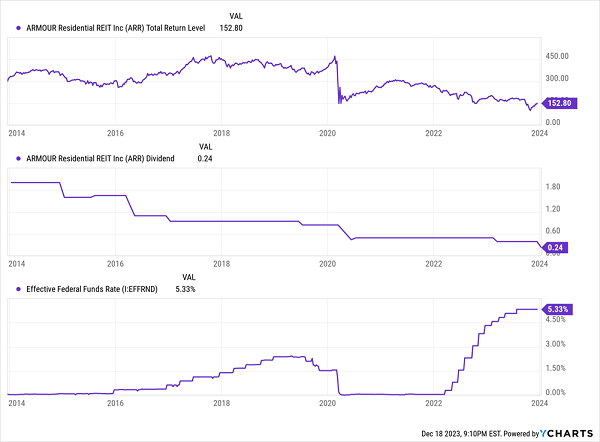

Armour Cracks No Matter What Rates Are Doing

That middle chart is what makes Armour an absolute no-go for me. The stock has been in a perpetual state of dividend decline since 2011. So as juicy as the current yield might be, there’s no precedent to support the idea that our future earnings will be nearly so sweet.

Ready Capital (RC, 13.6% yield) is a more palatable choice. This mREIT originates, acquires, finances and services small- and medium-sized balance commercial loans. Roughly half its core earnings are derived from bridge loans, while the rest is a combination of construction loans, fixed-rate CMBSs, Freddie Mac loans, small business lending and residential mortgage banking.

It’s also a bigger company than it was just a year ago; in May, it announced the completion of a merger with Broadmark Realty Capital, a specialty real estate finance company that originated and serviced residential and commercial construction loans.

Ready’s dividend is hardly pristine, but it has been much more stable across the mREIT’s publicly traded life. While it did drop from 40 cents earlier in 2023 to 30 cents to start 2024, it’s expected to be temporary—it’s largely a result of absorbing Broadmark’s tighter-margin portfolio. But when and if the merger starts to yield fruit, the payout should rise again—an appealing prospect for a stock that’s already yielding nearly 14%.

Now, I want to jump into more tangible equity REITs. And I’ll start with Highwoods Properties (HIW, 8.7% yield), an office REIT focused on southern and southeastern markets such as Atlanta, Charlotte, Dallas, Nashville and Orlando.

You can tell just how awful office real estate has been just by looking at this PR job on its website: “We’re in the work-placemaking business, creating environments that spark experiences where the best and brightest can achieve together what they cannot apart.”

When they don’t even want to say the word “office,” you know it’s bad.

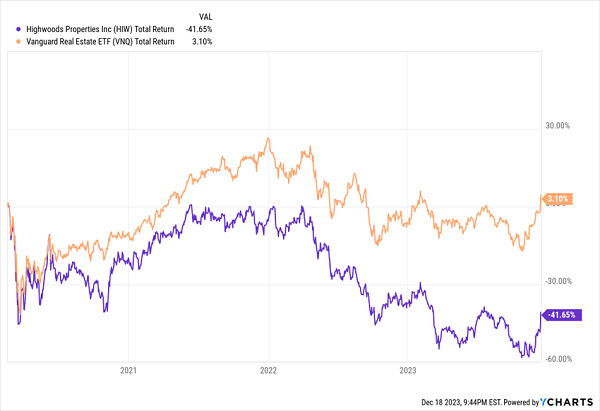

Following COVID, Highwoods actually managed to get back around its pre-pandemic highs by 2021—but after treading water for a year or so, the Fed started to hike rates, and shares are down by about 40% since then, severely lagging the broader real estate sector.

Highwoods Has Been Depressed for Years

There’s little reason to be bullish on office real estate broadly. While a return-to-the-office mentality has gained steam, many tenants are still downsizing. Where there is opportunity, however, is that many of these tenants are simultaneously upgrading into better-quality (and higher-priced) real estate. That bodes well for HIW, which is generally a good operator whose cash, FFO, and other important metrics have largely trended in the right direction for a decade or more.

Service Properties Trust (SVC, 9.7% yield) is a rarity in the REIT space, featuring a dual focus of hotel real estate and retail assets. Its portfolio consists of 221 largely extended-stay hotels across most of the U.S., Puerto Rico and Canada, as well as 761 service-focused retail net-lease properties. The latter is heavily tied to TravelCenters of America / Petro Stopping Centers, which make up more than two-thirds of annualized minimum rent, as well as other tenants including The Great Escape and Life Time Fitness.

A couple of months ago, I said I was curious about whether SVC could keep up its momentum after October 2022’s massive dividend increase. But its October 2023 dividend announcement came and went without a hike.

That’s not to say SVC won’t raise the dividend at some other point in the future, but it’s not building a habit. That’s not shocking. As I mentioned, while SVC has excellent dividend coverage, it also has more than $1 billion in debt maturities to address in each of the next two years. It’s also sinking a lot of money into upgrading its Hyatt (H) and Sonestra hotels. Patience is a must with this one.

Uniti Group (UNIT, 10.9% yield) is a REIT that provides telecommunications infrastructure. It’s a top-10 fiber provider in the U.S., boasting more than 139,000 fiber route miles and more than 8.4 million strand miles of fiber, connecting 300 metro markets and providing high-speed and networking services to more than 28,000 customers.

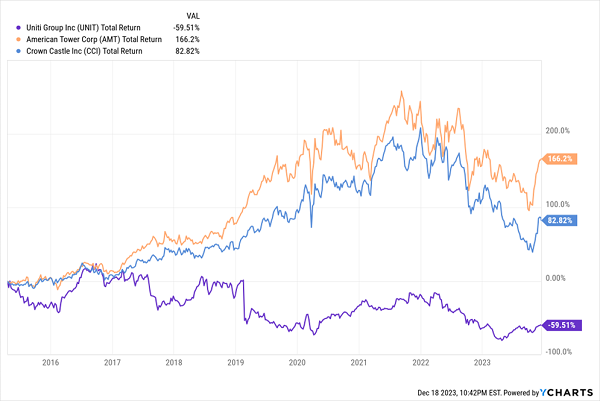

While Uniti’s infrastructure powers effectively what are basic necessities at this point, the REIT—a spin-out from regional telecom carrier Windstream—just hasn’t been as reliable as other comm infrastructure names like American Tower (AMT) and Crown Castle International (CCI).

Uniti Group Can’t Connect With Shareholders

Rate cuts would be most welcome to Uniti, but even lower-but-still-high rates don’t bode well given high leverage—the company currently boasts $5.6 billion in debt compared to just $34 million in cash. That could very well pressure the high dividend—currently the only thing UNIT stock really has going for it.

Less than two months ago, Brandywine Realty Trust (BDN, 11.5%) looked like dead money—it had lost more than a quarter of its value and was in desperate need of a rebound. Fast forward just a few weeks, and it’s actually sitting on modest gains.

Not much has changed for this hybrid REIT, which owns a mix of properties—more than 40% residential, life science at 27%, 24% office, and the remainder peppered throughout various real estate types—in scattered markets including Philadelphia, the greater Washington, D.C. area, and Austin, Texas. It’s still just a few months removed from a 21% dividend cut. It’s also still dealing with below-expectation occupancy and hundreds of millions of dollars of notes and JV debt maturing in 2024.

But the fact that it’s still dirt-cheap, at roughly 4.5 times next year’s estimates for funds from operations (FFO), makes it difficult to bet against.

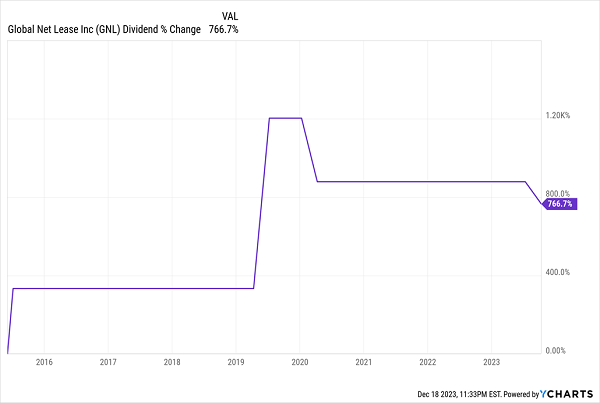

Global Net Lease (GNL, 15.1%) is also an extremely high yielder despite its dividend heading in the wrong direction—again.

GNL: Two Dividend Cuts in Four Years

Global Net Lease is a commercial REIT operator with assets not just in the U.S., but also in 10 other nations, including the U.K., Netherlands, Finland and France. It boasts more than 1,300 properties leased out to 815 tenants spanning some 96 industries. It’s an enormous step up for the real estate portfolio, courtesy of its merger with The Necessity Retail REIT, which was completed in September. That combo made it the third-largest publicly traded net lease REIT.

While GNL says the deal should be 9% accretive to annualized adjusted FFO per share during the first quarter after closing, and meaningfully reduce net debt to adjusted annualized EBITDA, I’d like to see something a little more concrete.

For now, Global Net Lease is on my watch list. The big event circled on my calendar is the company’s Q4 earnings release, due out in February 2024, when we should also get its first earnings guidance for the combined entity.

Earn a Reliable 9%+ in Retirement—Paid MONTHLY

All of these high-yielding REITs have at least a few promising elements, but a couple are yield traps, while a few others need a little more time to bake.

So if you want to make 2024 the year you get serious about building a retirement portfolio that can sustain you on dividends alone, you’ll need investment-ready income powerhouses—just like the beautifully boring, high-yielding blue chips I hold in my “9%+ Monthly Payer Portfolio.”

I want to give you more than tickers, though. I also want to help you understand why these assets do what they do so you can make an informed decision that’s best for you and your family.

As we turn the page from 2023 to 2024, it’s time to get serious about locking down our core retirement holdings. Start today! Click here to learn everything you need about these generous monthly dividend payers right now!

This post originally appeared at Contrarian Outlook.

Category: Real Estate