Make Money When Oil Prices Climb And When They Fall

When I learned about the business operations of refining companies a decade ago, I became a fan of the sector and the long-term profit rewards that investors can earn from it.

The energy sector is divided into three subsectors. Upstream energy companies drill for oil and gas. These companies receive a lot of attention because commodity prices drive their business results. Midstream is the transportation and storage of energy commodities. These companies operate pipelines, storage facilities, and terminals.

Midstream stocks offer attractive, stable dividends, which are highly sought after by income-focused investors. Downstream energy encompasses the companies that refine crude oil, natural gas, and NGLs into final-use products, as well as the marketing of these products.

Large-cap energy stocks, such as ExxonMobil (XOM) and Chevron (CVX), operate in all three sectors. Smaller energy companies are typically focused on a single sector.

Crude oil refiners are fascinating because they operate extremely complex refineries and must be very efficient. For a refiner, both the input, crude oil, and the output, gasoline and other fuels, have prices set by market forces. Profit margins per barrel of processed oil can swing dramatically.

In the U.S., we have three refining companies of similar size:

- Marathon Petroleum Corp (MPC), $51 billion market cap

- Phillips 66 (PSX), $48 billion market cap

- Valero Energy Corp (VLO), $41 billion market cap

Of the three, Marathon Petroleum has provided the best returns to investors and has been a long- recommended stock in my Monthly Dividend Multiplier newsletter service.

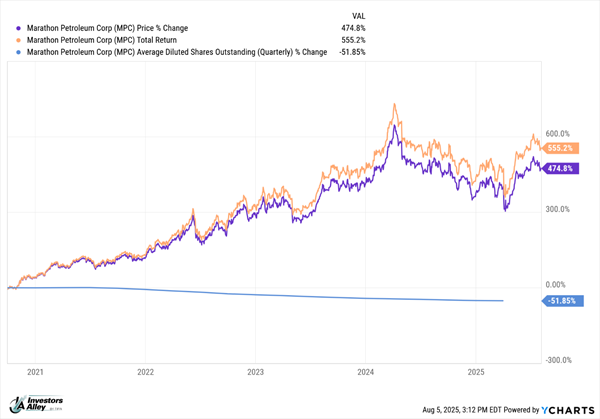

Marathon’s returns have been driven by steady 10% annual dividend growth and the company’s buyback of outstanding shares, which automatically boosts net income per share. The dividend has increased by 57% over the last five years, while the number of shares outstanding has decreased by 52% during the same period. This chart shows the five-year share price and total returns for MPC. Yes, investors earned 555% over the last five years.

Dividend growth stocks, such as MPC, can provide excellent long-term returns in your portfolio.

This post originally appeared at Investors Alley.

Category: Commodities