Insider Buying Is Bullish For These Dividends Up To 7.5%

If they’re buying, we’re buying.

Or we’re at least considering it.

If there’s anything better than a big dividend, it’s one that is being gobbled up by the company’s own insiders. We’re talking about the officers, directors, and other members of the C-suite that are closer to the action than any analyst, reporter or investor could ever hope to be.

Most insiders are sitting on their hands right now. And who could blame them given the bubbly backdrop? But three management teams in particular are saying:

Our stock is cheap. Our dividend—up to 7.5%, by the way—is safe. We’re in with our own cash.

Who are these insiders? And more importantly—who do they work for? (Hat tip, Austin Powers.) Well, they run firms that are dishing big dividends. Let’s have a look.

Western Midstream Partners LP (WES)

Distribution Yield: 7.5%

Recent Noteworthy Buys:

- Director Kenneth F. Owen: 7,000 shares ($237,720) on 2/26/2024

- Director David J. Schulte: 800 shares ($27,392) on 2/27/2024

- Director Oscar K. Brown: 7,000 shares ($236,218) on 2/28/2024

- Director Lisa A. Stewart: 5,000 shares ($170,625) between 2/28/2024-3/6/2024

- President and Chief Executive Officer Michael P. Ure: 5,000 shares ($168,250) on 3/1/2024

We’ll start with Western Midstream Partners LP (WES), which manages 24 gathering systems, 75 processing and treating facilities, and roughly 16,000 miles of pipeline spread across seven natural gas pipelines and 15 crude oil and NGL pipelines. Its core assets are located in the Delaware and DJ Basins in the southwestern and western U.S., though it also has some assets in Pennsylvania.

When it comes to insider buying, we often must read the tea leaves to divine what management is optimistic about.

With WES, it’s very likely one of two drivers.

In its Q4 2023 report, Western Midstream signaled that it expects to raise its distribution by a whopping 52% to 87.5 cents per unit—a move that would raise its yield to above 10% at current prices.

So it wouldn’t be much of a surprise if a gaggle of WES insiders bought nearly 25,000 shares combined—a collective $840,205 worth of purchases—over the past month or so to collect even more distributions.

But it’s also possible that WES directors and officers are also looking to cash in on a potential sale of a major stake. Occidental Petroleum (OXY) owns 49% of Western Midstream, and it also controls the firm through its ownership of its general partner.

Both pieces of news were reported within a day of one another, sending shares collectively about 15% in less than a week.

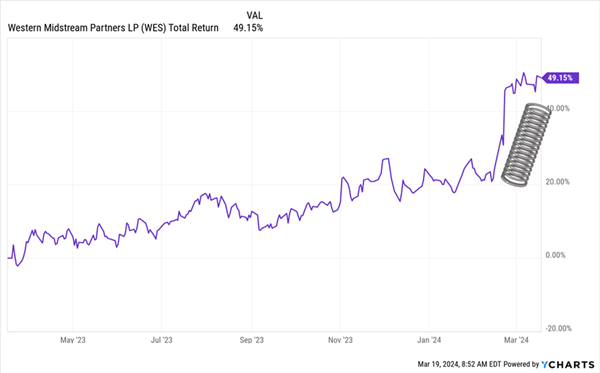

Western Midstream Springs to Life

Western Midstream itself says it hasn’t launched a sale process, so it’s at least possible WES doesn’t get sold, which would likely result in shares giving up some of their gains. And the stock is a bit frothy after its February run.

I’ll also point out that Western is a master limited partnership (MLP) that comes with the added complication of a K-1 tax form, which I try to avoid.

Capitol Federal Financial (CFFN)

Dividend Yield: 6.1%

Recent Noteworthy Buys:

- Chief Lending Officer Rick Jackson: 12,990 shares ($74,321) between 2/21/2024-3/1/2024

- Director Huey Morris: 9,000 shares ($50,820) between 2/28/2024-3/4/2024

Longtime readers might be familiar with Capitol Federal Financial (CFFN), a former Hidden Yields holding from yesteryear.

To those who aren’t: Capitol Federal is the parent company of Capitol Federal Savings Bank, a Topeka, Kansas-based regional bank boasting more than 130 years of operations. The bank, which has roughly 50 physical locations, specializes in residential landing in both Kansas and Missouri.

Reaching $10 billion in assets means examinations and increased scrutiny by the Consumer Financial Protection Bureau. The scrutiny will be greater, the communication more frequent.

After enjoying a fantastic total return in a very short time, we booted CFFN from the Hidden Yields portfolio a little more than seven years ago amid a drastic plumping in its price-to-book.

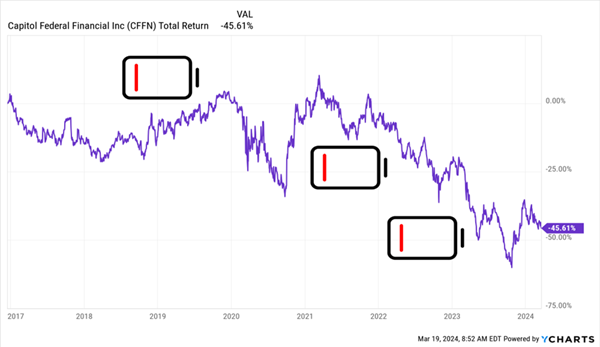

It’s fair to say our exit timing was spot-on.

CFFN’s Opportunity Was All Tapped Out

CFFN spent much of 2023 in the doldrums amid margin issues from its efforts to keep its assets below $10 billion—an important threshold that invites more scrutiny from the Consumer Financial Protection Bureau. It even failed to pay a special dividend—not unusual for most companies, but certainly disappointing for Capitol Federal, which had been paying at least one (and more often two) annually for years.

The bank is in an interesting spot now. It sold $1.3 billion, or 94%, of its securities in a massive restructuring that helped provide some liquidity, which CFFN could use to shift toward more commercial lending.

Wall Street hasn’t exactly bought in yet—after a late 2023 recovery, shares have sunk by double digits in 2024—but insiders seem to think their plan will bear fruit. Insiders Rick Jackson and Direct Huey Morris recently bought nearly 22,000 shares for about $125,000.

Broadstone Net Lease (BNL)

Dividend Yield: 7.5%

Recent Noteworthy Buys:

- Director Michael A. Coke: 10,000 shares ($146,700) on 2/26/2024

- Chief Executive Officer John David Moragne: 10,000 shares ($147,700) on 2/26/2024

- Chief Financial Officer Kevin Fennell: 4,000 shares ($58,520) on 2/27/2024

- Director Shekar Narasimhan: 5,000 shares ($74,350) on 2/28/2024

Broadstone Net Lease (BNL) is a net-lease REIT that specializes in single-tenant commercial properties. And its C-suite is particularly keen on their own stock right now—near the end of February, insiders bought 29,000 shares worth about $427,000.

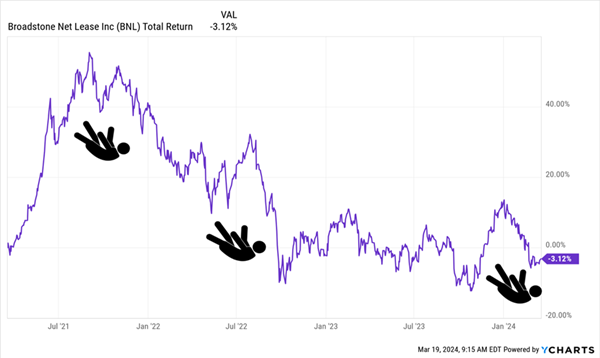

If nothing else, they might just be taking advantage of another slide back into the basement.

Broadstone Net Lease Can’t Escape This Funk

Broadstone currently boasts 796 properties across 44 states and four Canadian provinces, and those properties are more than 99% leased out at the moment. Industrial properties make up a little more than half of annualized base rent, followed by healthcare (18%), restaurants (13%), retail (11%) and office (6%). But BNL is working to concentrate on industrial, restaurants, and retail, with plans to sell 75 healthcare assets (~11% of total company ABR). Of those, 37 properties (5.1% of ABR) are already under executed contracts.

The renewed portfolio focus is a benefit to BNL, at least in my view. But it almost certainly will hinder already weak earnings performance in the short term.

Give Me 4 Minutes, I’ll 5X Your Retirement Income

First-level investors typically assume that dividend investing is a balancing act: Lower yields always equal lower risk, while higher yields always equal higher risk. So they often pinch their nose right before diving into high-yield dividend traps.

But they don’t have to do that!

My “Perfect Income” portfolio attacks retirement investing from a different angle. Rather than trying to time the market and chase trends, we target high-yield holdings (roughly 5x the S&P!) that walk their own path, no matter what the Fed, Congress or the rest of the world throws their way.

So, what makes these dividends “perfect”? Well, they have to have a few things in common:

- They DO pay consistently, predictably and reliably.

- They DO survive—and even thrive—in market crashes.

- They DO deliver double-digit returns, with safe, secure investments.

- They DO require minimal management time—just a few minutes every month!

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks