The Dirty Secret Behind The Clean-Car Revolution (And A “New” Way To Profit)

“They’re ticking time bombs waiting to explode.”

I recently ran into a guy I hadn’t seen in 20 years.

He’s a car salesman. I asked his opinion on electric vehicles.

“I wouldn’t touch them with a bargepole. You see the videos of EVs turning into giant fire balls online? They’re ticking time bombs waiting to explode. And anyway, all that climate change stuff… it’s a hoax.”

So… not a fan.

Here’s the truth: Whether he agrees or not: EVs will be one of the defining disruptions of the next decade.

But the best way to make money from this disruption isn’t buying Tesla (NASDAQ:TSLA)… or other automakers going green.

Today, I’ll share my top “backdoor” stock to profit from the coming EV boom.

Global EV Sales

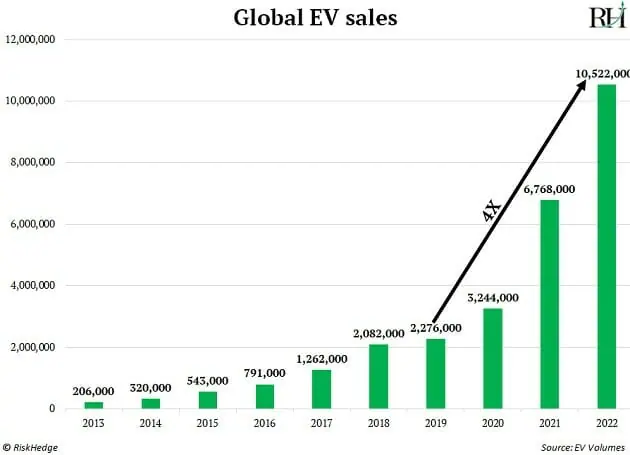

- Tell me this isn’t one of the prettiest charts in the world…

A record 10.5 million new EVs hit the roads last year. That’s a 4X surge since 2019:

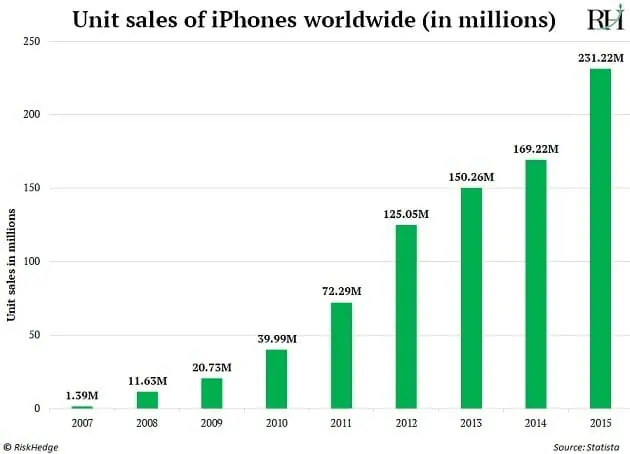

This reminds me of iPhone sales a decade ago.

Shipments surged 15X between 2007 and 2009. That was incredible growth. Yet, look back today, and you have to squint to see increasing sales figures:

Since 2020, EV sales as a percentage of the total auto market have more than tripled to 14%. In fact, car lovers spent a record $425 billion “going electric” last year.

The Secret Behind The Clean-Car Revolution

- Here’s the dirty little secret behind the clean-car revolution…

Folks cruising around in EVs think they’re saving our kids from asthma-filled lungs.

They imagine a green utopia, where towering trees sway in the gentle breeze, providing shade to lush plants.

Let me shatter their dreams for a moment…

Remember best-selling artist Moby? Everything Is Wrong was his breakthrough album. I remember there was a list of facts inside the album’s booklet. One that always stuck with me was: 80% of USDA chicken inspectors no longer eat chicken.

Want to know how the (EV) sausage is really made?

Unlike regular gas guzzlers, when you pop the hood on an electric car, you won’t find an engine.

Electric cars run on batteries like the one in your smartphone… just 10,000X more powerful.

A humongous amount of “stuff” is needed to power these batteries. For example, there are 180 lbs. of copper and 140 lbs. of lithium under the hood of a Tesla Model S.

These materials don’t grow on trees. You can’t make them in sterilized test tubes.

You have to pull them out of the ground. And that requires giant, rusty excavators… larger-than-life trucks… and lots of dirty, filthy mining.

This is the grimy underbelly of the green revolution you don’t see on TV.

Mining Companies Are Racking It In

- Houston, we’re going to need a lot more “stuff.”

The transition from regular gas guzzlers to EVs doesn’t just require a little more copper and lithium.

Tesla, Ford (NYSE:F), and others are tearing the hinges off the door to get their hands on these materials.

The amount of money automakers spent on lithium surged 12X to $35 billion in the past two years alone. And we ain’t seen nothing yet.

Humans mined a combined 700 million tons of copper over the past 5,000 years. Bloomberg estimates we’ll need to mine the same amount over the next 20 years to meet our current climate goals using wind, solar, and EVs!

Surging EV sales are impressive. But the real boom is in the raw materials powering our sleek, new battery-powered cars.

Automakers are spending the money. Mining companies are the ones raking it in.

The revenues of the top 40 mining companies shot up 30% over the past two years, while profits more than doubled.

Opportunity In Copper

- The greatest investor alive knows how to profit from this hidden boom.

Stan Druckenmiller is a reclusive billionaire who rarely gives interviews. But his track record is astonishing…

“Druck” strung together 30 straight profitable years from 1980 to 2010. During that time, he earned returns of 30% per year. If you took $10,000 and compounded it at 30% per year for 30 years… you’d amass a $26.2 million fortune.

In a rare interview, Druck was asked what he’s investing in today…

“Copper is in the tightest position, frankly, I’ve ever studied. Given the move toward EVs… it’s hard to believe copper won’t be a huge beneficiary.”

Copper is a special metal that’s excellent at letting electricity flow through it. It powers everything from toasters to air conditioners to computer chips. In fact, there are 400 lbs. of copper in the average US home.

There are 180 lbs. of copper in a Tesla Model S. Copper’s used in the wires and cables that carry the electricity from the battery to the motor.

Battery-powered cars need almost 3X as much copper as a regular gas guzzler.

Surging EV sales are expected to double the demand for the “red metal” over the next decade, according to S&P Global.

There’s a huge squeeze setting up in the copper market over the next few years, which should push prices much higher.

We’ll need more copper than ever before. But it takes 10 years to get a new copper mine up and running. And almost none are being built.

Consulting giant McKinsey estimates there will be a shortfall of six million metric tons of copper per year by 2030.

Freeport-McMoRan

- Here’s my top “backdoor” stock to profit from the squeeze.

Construction firms are the largest buyers of copper.

When China was booming in the 2000s—building ghost cities, wiring and plumbing millions of apartments—copper prices jumped 800% over the decade.

“EVs” are the new “China.” A disruptive force that will send copper demand through the roof.

Our research suggests copper prices could repeat their 800% surge over the coming decade… and that’s being conversative.

Last year alone, lithium prices more than doubled on the back of record EV sales…

Which is why I recommend buying Freeport-McMoRan (NYSE:FCX). Freeport is one of the world’s largest copper producers. It also operates the world’s largest gold mine, the Grasberg mine in Indonesia.

Freeport could easily triple in the coming years as copper demand surges higher.

This post appeared at ValueWalk.com. It was contributed by Stephen McBride – Chief Analyst, RiskHedge.

Category: Commodities, Stocks