Major Tech Stock Goes On Sale!

Tech stocks had a horrible last few days.

The NASDAQ 100, widely considered the best index for tech stocks, was down over 4% at one point for the week.

Concerns about artificial intelligence (AI) dragged down some big players like Nvidia (ticker: NVDA), Alphabet (ticker: GOOG), and Amazon (ticker: AMZN).

Microsoft (ticker: MSFT) is worth almost $3 trillion.

It’s one of the largest companies around.

If you bought 1 share of Microsoft for $21 in 1986, you’d have over $85,000 today.

Any investor would love to have returns like Microsoft’s!

But Microsoft investors haven’t had a great time the last few weeks.

Since January 28, Microsoft is down almost 20%.

It all started when Microsoft reported earnings for Q2.

Microsoft beat analyst expectations, but concerns about capital expenditures (capex) crashed the stock.

Capex is how much a company spends on things like equipment, factories, or technology.

Microsoft spent almost $30 billion in capital expenditures in Q2, which is almost double what it spent in Q2 last year.

A lot of the investment is for AI development.

Sales in Azure, Microsoft’s cloud computing software used for AI development, rose 39% in Q2 compared to last year.

39% growth is great, but isn’t so great when you’ve doubled the money you invested to grow the product.

Plus, Microsoft announced about 45% of Azure’s future contracts are with OpenAI, creator of chatbot ChatGPT.

It’s a huge amount of exposure to a single company.

Microsoft’s stock continued to fall days after the earnings release as people got more and more worried about AI and Microsoft’s investment.

If AI is in a bubble, which is possible, Microsoft is going to fall even further.

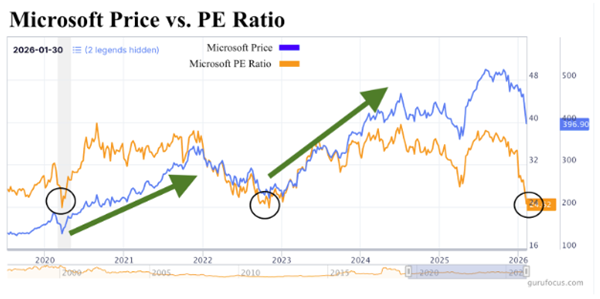

But look at Microsoft’s price-to-earnings (PE) ratio for a bit.

Microsoft’s PE ratio is currently 25x, which is right around its industry average.

However, Microsoft’s historical PE ratio is around 33x.

PE ratios are really important in the stock market.

They measure how much you’re paying for a company’s earnings, so a lower number is better.

So even though the stock price is much higher than it was a few years ago, Microsoft’s stock is actually cheaper relative to its earnings.

The last time Microsoft’s PE ratio was around 25x was in 2022…

…And Microsoft’s stock price rose 60% over the next 12 months.

Microsoft’s PE ratio was also around 25x during the COVID pandemic.

And Microsoft’s price rose almost 70% over the next 12 months.

There’s no guarantee it will happen again.

But I think Microsoft is trading at a really interesting price right now.

The tech stock is incredibly profitable.

Microsoft’s profit margin of 39% is one of the highest in the software industry.

And over the last decade, Microsoft has grown its revenue by an average of almost 14% each year.

Sure…AI might be overhyped.

But AI isn’t going away!

And Microsoft will be there to make lots of money.

What tech stocks are you buying right now?

Coach Parker

Category: Stocks