Why Stocks Will Crush All-Time Highs (And The 8%+ Dividends To Buy)

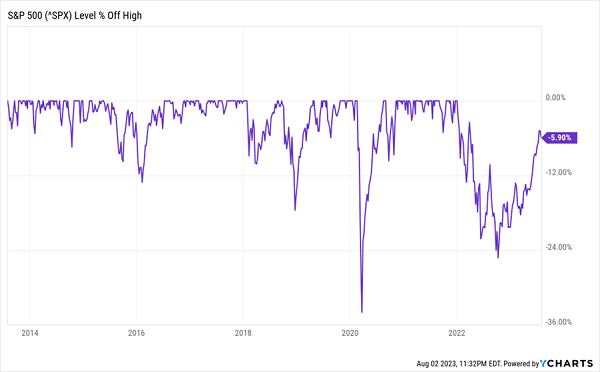

Don’t listen to the bubble worrywarts: even with the 2023 bounce, stocks are well off their late 2021 peak. In other words, they’re still cheap!

Stock Rebound Still Has Room to Run

We can get in even cheaper through discounted closed-end funds. Consider two leading equity CEFs, the Liberty All-Star Growth Fund (ASG) and the Eaton Vance Tax-Managed Diversified Equity Fund (ETY), which yield 7.8% and 8.2%, respectively.

Both deal in blue chips like Visa (V), Amazon.com (AMZN) and Microsoft (MSFT). ASG also adds some lesser-known midcaps for extra growth (hence the “growth” in the name), such as property manager FirstService Corp. (FSV) and SPS Commerce (SPSC) a maker of software for managing supply chains.

Which brings us back to the discounts: as I write, ASG trades at a 4.5% discount to net asset value (NAV, or the value of its underlying portfolio), well off its five-year average of a 1% premium.

ETY, for its part, trades at a 0.8% discount, more or less at its five-year average, but this one has upside thanks to our still-off-peak market and another reason the press has been pretty sheepish about lately: experts from Goldman Sachs (GS) to CNN are changing their calls on the likelihood of a recession.

Experts (Finally) Clue in to What the Data’s Been Saying All Along

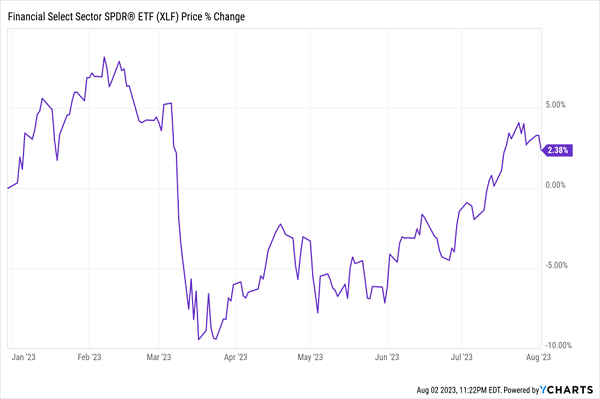

Truth is, recent economic trends that were supposed to set the (negative) tone for the coming years have turned out to be, well, duds. Remember the banking crisis? It lasted about a month.

The Banking Crisis Was Supposed to Touch Off a Recession (Then Fizzled)

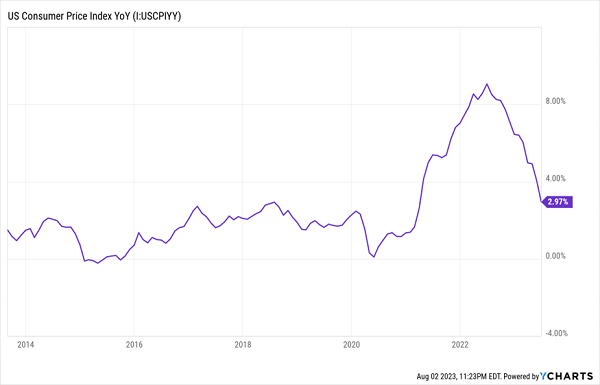

Inflation was a big worry, too … a year ago. But the consumer price index is now below 3% and trending down.

Deflated Inflation Risks

As a result of these changes, many experts are changing their calls. But that’s not the case at my CEF Insider service. Throughout last year, we followed the data (as we always do!) and bought our favorite CEFs at some very nice discounts, locking in 8%+ income streams as we did.

In late September 2022, a little under two weeks before stocks hit their lowest point since the pandemic, I wrote:

“Why do I see the market returning to health next year? Because there are many good-news stories that have yet to break through the gloomy mood out there.”

What followed was a steady stream of advisors and economists reversing their recession predictions.

Most recently, Bank of America (BAC) joined the fray, following the Federal Reserve a couple weeks ago. The bank’s economists wrote in a recent note that “recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the US economy.”

This isn’t the first time the bank’s economists have changed their minds. In September 2022, they revised their call for a recession to the first half of 2023, which was changed again to the third quarter, just six months later, in March 2023. Now, another five months later, they’ve moved the goalposts again.

The data behind our bullish view at CEF Insider is strong, and we’ve discussed it in previous articles (like this one from July 13), so no need to retread that here. Instead, let’s talk about how quickly this market is recovering.

2022 was what financiers call a non-recessionary technical bear market, meaning it fell 20% with no macroeconomic justification (or no recession, in other words). Last time we saw something similar was in 2018. Back then, the market recovered quickly, in just seven months.

We’re 19 months into this bear market, and we still aren’t at breakeven. That’s slower than in 2018 and only a month off the average breakeven point for a bear market, which is 20 months. So It’s no surprise that many people are buying stocks now.

This is where discounted CEFs like ETY and ASG are smart plays. In addition to their discounts and upside as recession calls fade, you’re getting a rich income stream you can use to pay your bills or maybe even buy a new car or home.

If you were to put $100,000 in each of these funds, you’d collect $1,333 on an annualized monthly basis, based on their current forward yields (though because ASG’s dividend is pegged to its NAV performance, this may float a bit). And the more you put in, the more income you’d get.

5 (Comically) Overlooked CEFs That Pay $10,200 on Every 100K Invested

ASG is a great play at this stage of the rebound, but you don’t need to limit yourself to equity CEFs here. Truth is, there are plenty of opportunities in other CEFs, too, from corporate bonds to real estate investment trusts (REITs), municipal bonds and more.

In fact, now is the time to build a diversified CEF portfolio and “lock in” these funds’ high payouts at BIG discounts (before these deals disappear in the ongoing rebound).

To help you do just that, I’ve assembled a 5-CEF “mini-portfolio” that does two critical things:

- Pays high dividends, with an incredible average yield of 10.2%.

- Trades at outrageous discounts, setting the stage for 20%+ price gains in short order.

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks