3 ETFs To Buy Before They Charge Higher In 2018

The markets continue their bullish run into year-end. Here’s how to profit.

The market continues to press higher as the heightened prospects of a tax reform deal has seemingly filled the rally tank as we head into the end-of-the-year, which is normally bullish for stocks and ETFs to buy.

Investors are beginning to scramble for new opportunities for their sideline cash, but with the major indices hovering near their highs, the feeling that there aren’t any “deals” or “value plays” left is growing.

A look at the exchange-traded fund universe finds that the recent pullback has opened the door for some value allocations into already strong performing sectors. In addition, some signs that pessimism is still alive in a few sectors means that they haven’t reached the tipping point of being over-loved … a sign that the rally is over.

These three ETFs to buy have demonstrated technical strength amid the recent pullback, making them strong picks as we head into the new year.

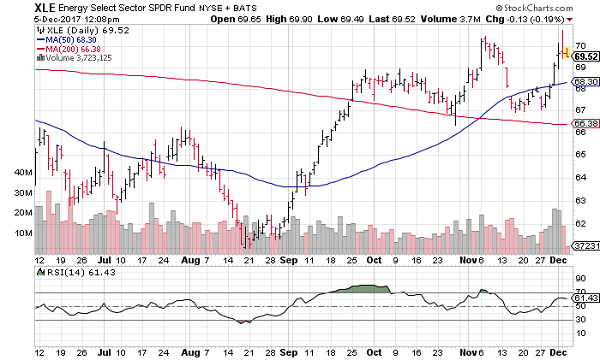

ETFs to Buy: Energy Select Sector SPDR (XLE)

The recent trading range for crude oil prices is likely to be a rest, not a reversal as OPEC’s policy appears to be holding prices in a slow trend higher. The long-term charts for “Black Gold” indicate a bull market that is likely to continue through 2018, resulting in a fundamental tailwind for the Energy Sector.

The Energy Select Sector SPDR (ETF) (NYSEARCA:XLE) has been in a 4% trading range, while crude oil has consolidated ahead of its next move higher, but the once-hated ETF is preparing for a breakout above $70.

The technical strength and momentum of XLE shares are evidenced by the recent Golden Cross technical pattern that was drawn in early November as the 50-day moving average crossed above the 200-day moving average. This is often a sign of strength for a stock or ETF over the following 3-6 months.

Sentiment toward these stocks remains pessimistically tilted as indicators like short interest and analyst recommendations on the component companies indicate that the energy sector remains “uncrowded.”

Our forecast for the Energy Select Sector SPDR ETF remains bullish with a target of $80 during the first quarter of 2018.

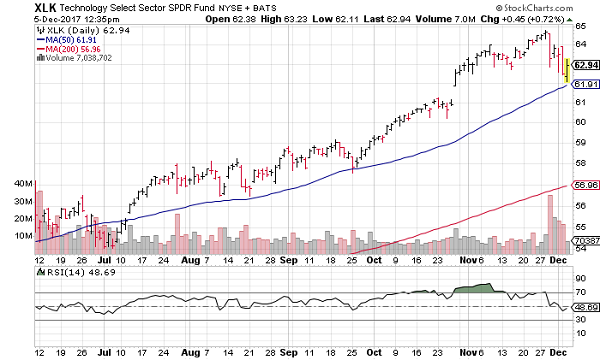

ETFs to Buy: Technology Select Sector SPDR (XLK)

There has been a migration from the technology sector to more industrial stocks over the last month or so as traders looked for relative values in the market. This migration has resulted in a stall of the Technology Select Sector SPDR Fund (NYSEARCA:XLK) after the last surge higher in the end of October.

With names like Apple Inc. (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Facebook Inc (NASDAQ:FB) and Alphabet Inc (NASDAQ:GOOG, NASDAQ:GOOGL), XLK has been one of the stronger performers for the year, but the recent consolidation is more a result of portfolio managers locking-in profits before year-end than an end to the trend.

Sentiment toward the top holdings in the Technology Select Sector indicated that a short-term pullback was likely in November as these and other popular technology companies had become overcrowded with bullish investors. These crowded trades often result in a healthy correction or consolidation, as we’ve seen with the XLK shares.

Watch for the technology sector to get a strong year-end finish as well as a boost in the new year as semiconductor companies continue to drive the tech sector higher. Our outlook for the first quarter of 2018 includes a price target of $75.

ETFs to Buy: SPDR S&P Retail (XRT)

Can it really be true that the retail sector is back? The technical picture and current sentiment says “yes”.

We’ve seen the brick and mortar retail companies make a comeback as fundamental changes and some consolidation has made them a value proposition. Now, the technical picture is improving on the SPDR S&P Retail (ETF) (NYSEARCA:XRT) shares, which is drawing the technical traders back into this long-hated ETF.

Looking at the chart, the recent break above $42 served as a rally cry for the XRT shares. In making the move, the 50-day moving average crossed above the 200-day, forming a “Golden Cross” like we’ve seen in the energy sector. This bumps the bullish outlook for the retail sector as it signals that the “trend is your friend” with the retail stocks.

As can easily be imagined, the sentiment toward the retail sector is very pessimistic. Our proprietary company-weighted Short interest ratio for the XRT ranks the highest of any other SPDR sector-based ETF. This indicates that the likelihood that short covering rallies will help to fuel continued gains for the XRT shares is high.

Watch for the bulls to start moving into this sector as it gains momentum and heads toward our first-quarter 2018 target price of $53.

As of this writing, Johnson Research Group did not hold a position in any of the aforementioned securities.

See Also From InvestorPlace:

- 5 Stocks to Buy That Pay Sustainable Monthly Dividends

- 10 “Best of the Best Stocks” to Buy for 2018

- 10 Reasons the Tax Plan Is Bad for Stocks

Category: ETFs