Why You Should Be Trading 0DTE Options

Short-term options trading has exploded over the last few years. It started with the creation of weekly options back in 2005 which are options that expire every Friday. These options are available on many individual stocks and ETF’s and can provide quick returns for active traders.

The Rise of Weekly/0DTE Options

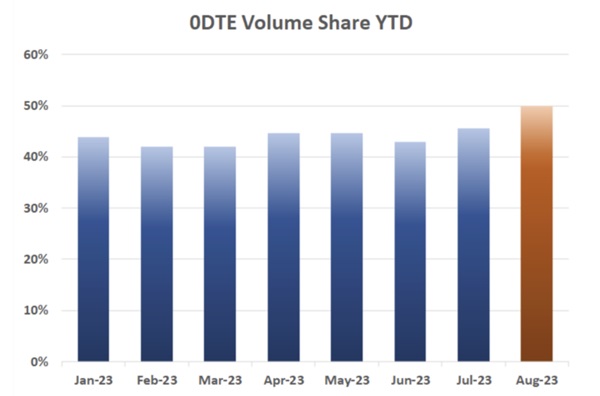

With the explosive growth of Weekly Options, exchanges have tried to build on that popularity by adding 0DTE (0 days to expiration) options which are options that expire at the end of every trading day. These products are available on a handful of markets but the main ones are the index products. The volume from the 0DTE options now makes up over half of the daily options volume on the S&P 500 (SPX). Like them or not, they are here to stay and will most likely become available in more markets in the years to come.

Many of the big market moves that we have seen over the last few months are a direct result of 0DTE and Weekly Options trading. With the pick-up in volumes, these short-term products can speed up market movement in a hurry.

Best Markets for 0DTE Options Trading

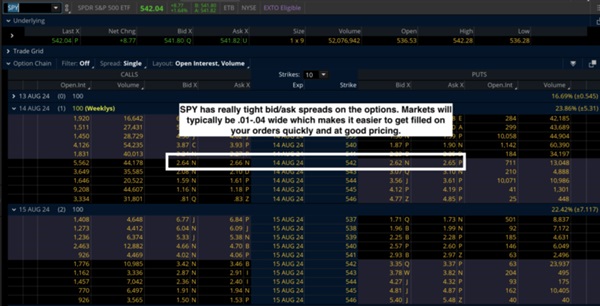

Let’s start by talking about the best markets for retail traders to utilize 0DTE options on. We prefer to trade the index ETF’s as they provide the best markets with tight bid/ask spreads, good volume, and lower costs for smaller traders.

Appeal of Index ETFs for 0DTE Options

The S&P 500 ETF (SPY), Nasdaq ETF (QQQ), and Russell 2000 ETF (IWM) are the three markets that we look at most often as they have options that expire every day of the week. All stocks and ETF’s that offer weekly options will provide an opportunity to use 0DTE options strategies each Friday, however, the index markets will be the best place to start as they provide trading opportunities Monday-Friday.

The index ETF’s can experience good price movement back and forth throughout the day. Using options on these markets can allow the retail trader to participate in the movement and in many cases for a few hundred dollars of capital or less.

These markets will allow you to trade options until 4:15 PM Eastern time which is 15 minutes after the equity markets close. This will allow you to better control the risk from the opening bell to just after the closing bell.

Risk vs Reward Of 0DTE Options

0DTE options have taken the idea of using leveraged products to produce large gains to a whole new level. They have taken the short-term nature of weekly options and strapped a rocket onto them which can lead to large market swings. It is very possible to see 50-100% returns on an option’s position in a matter of minutes. These swings can create massive opportunities for short-term traders but can also come with elevated risk if not used properly.

The Attraction of 0DTE Options for Retail Traders

Retail traders love to be in and out of trades quickly and like to do so with minimal amounts of capital. The 0DTE options sound like a perfect fit for this kind of trading. However, simply buying 0DTE calls options if expecting markets to move higher or buying 0DTE puts options if expecting markets to move lower is not enough. There are factors that you need to consider before placing a trade with these products. With so many great features available for retail traders, why wouldn’t everyone trade 0DTE options daily?

Risks of 0DTE Options

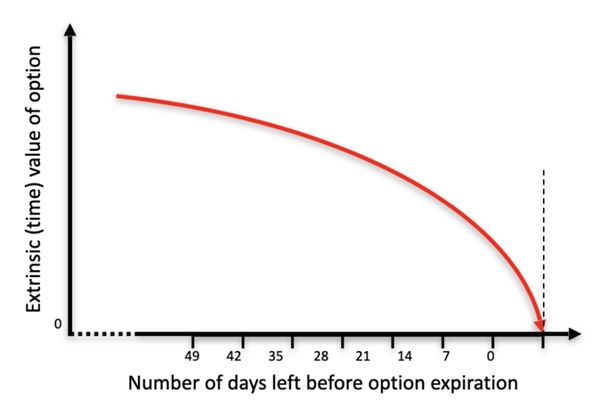

The low cost of the products and the ability to get in and out of trades quickly are attractive features of 0DTE options. However, they do have elevated risks associated with them as well if you aren’t careful. With these options expiring at the end of every trading day, the time decay (Theta) of the options will be extreme. This means the options will lose value at a rapid pace throughout the trading day.

As long as markets are moving in your favor this won’t be a big issue. However, if markets settle into a choppy environment you can lose money quickly strictly from the time decay adding up.Not only do you need to be right on market movement but you need to be spot on in many cases with the timing of the moves as well. You can certainly use these options by going out a few days but most retail traders use them to get in and out of trades in a matter of a few hours or less.

Upcoming Strategies for 0DTE Options

In an upcoming post, we will take a look at how you can best utilize different strategies using 0DTE options in all market conditions to produce more consistent results. Whether you want to take advantage of these products to profit from short-term market moves or you are trying to understand why the market can move so quickly during the day, the 0DTE options are important to be familiar with.

Aug 22, 2024 12:00 PM | Aug 22, 2024 07:00 PM

This post originally appeared at NetPicks.

Category: Options Trading