Which Investment Type Carries The Least Risk?

7 Low Risk Investments

A common question from investors with different experience levels is, “Which investment type typically carries the least risk?” First, when determining whether an investment is low risk, it’s helpful to figure out your risk tolerance and understand what low risk, safe investments mean. Then, you can examine the riskiness of an investment in terms of your specific situation. In investing terms, the least risky investment is typically one that does not expose the investor’s invested capital to extreme price fluctuations. But an investment portfolio of low-risk investments would be problematic if it only contained assets that have a steady principal value, like CDs or money market mutual funds.

The conservative income investor who is concerned exclusively with low-risk investing, might stick only with CDs, money market funds, and bonds. While you’ll protect your principal investment amount, these examples of low risk investments, don’t protect your money from declining in purchasing power, due to inflation.

In the end, any investment has a degree of risk, and investors should be careful in selecting investments solely with the goal of reducing risk. Before choosing an investment you consider low risk, consider the following factors.

What Is Investment Risk?

Investment risk comes in many flavors. The simplest type of risk is the potential loss of principal, or the loss of a portion (or all of) the original amount of capital placed into an investment.

But other types of investment risk exist. For example, the risk of a loss of purchasing power is often overlooked by novice investors. Some investments underperform inflation, so that – while you might see a numerical gain in your investment – you still lose a degree of your total purchasing power. This occurs when inflation is increasing and prices outpace the growth of your investment.

Today, investors in money market mutual funds, Treasury bills, and CDs will earn returns that outpace inflation, but that is not always the case. Examples of these types of low risk investments will vary based on interest rates and inflation levels.

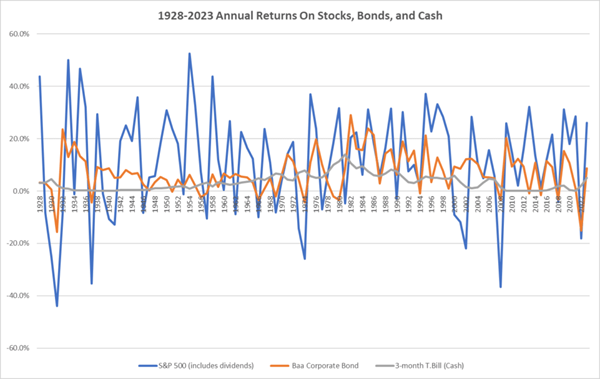

Investors should also consider their investment time horizons. You can reduce risk by investing with a longer time horizon, thereby making otherwise risky assets, such as stock funds, low risk enough for your portfolio. You can easily understand this by looking at a chart of the stock market: While the market does have the occasional violent setback, on a long enough timeline the market’s general trend is upward, and thus – on average – you will see gains over time.

Notice that during most years, stock market returns are positive and much greater than the returns of Treasury Bills, Treasury Bonds and corporate bonds. But, stock market investors must be prepared for occasional declines in value, typically much greater than those drops in fixed assets.

Be advised that risk is strongly correlated with expected return. The mathematical relationship is logarithmic for most investments, meaning that an investor sees diminishing returns for additional risk at higher risk levels; at lower risk levels, however, taking on a little extra risk produces significantly higher expected returns. Of course, less risky assets typically lead to a drop in expected returns.

Finding a comfortable position in the risk/reward relationship is one of the primary tasks for any investor. This is especially true for soon-to-be retirees, a group for whom research shows fears running out of money during retirement to be stronger than the fear of death. A whopping 38% percent of retirees will eventually run out of their savings due to neglecting to optimize their investment risk and reward.

For younger people, the biggest investment risk tends to be not investing enough rather than finding the best balance between risk and reward. The net value of a loss in a high-risk investment is lower for young people, who generally have less principal invested. A 10% loss in a young person’s $3,000 portfolio is only $300, but that same 10% loss could be unacceptable to a retiree who has a six or seven figure account.

Young people should instead focus on reaping the benefits of compound interest.

What Is the Difference Between a High-risk and Low-risk Portfolio?

For a portfolio, investment risk is best defined as the difference between the expected worst loss and realized worst loss. In this way, low volatility investments can actually be high-risk investments. For example, if your portfolio only contains low-risk utility stocks, your expected risk might indeed be low due to utility stocks not being especially volatile. However, such a portfolio is overexposed to a single risk, such as a bear market in the utilities sector or declining energy prices, and you could realize a much larger total loss than expected as you allocated too many assets to this sector.

This is why understanding the risks of each asset class is imperative in building a portfolio of a specific risk type.

Remember, the overarching goal of building a portfolio is to properly allocate assets to reduce risk while increasing potential rewards. The best way to determine the distribution of your investment dollars is to aim for diversification. Because assets of different classes have different risks and rewards. Diversification across multiple asset classes allows you to reduce the overall portfolio volatility and remain exposed to the large rewards that come with the higher risk investments.

Adding a long time horizon to a diversified portfolio pushes the risk even lower, essentially allowing you to add nearly anything to your portfolio provided you do not allocate too much capital to any single holding.

The 7 Best Low Risk Investment Options

Here are the best low-risk investment options, ordered from low-risk to high risk.

1. High-yield Bank Savings Accounts

A high-yield bank savings account is a savings account that pays interest rates significantly higher than the national average. You can check the national average interest with the FDIC here. Compared to the average bank savings account, the interest gained on your deposited savings is often enough to provide a return of approximately one percent or more than the average savings account interest rate. Several robo-advisors offer high yield cash accounts along with automated investment management like the M1 Spend account that pays 1% interest, Wealthfront Cash Account and M1 High Yield Savings account.

With rising interest rates, you’ll find your money-market and cash accounts are finally offering better returns. Wealthfront Save currently has among the best rates we’ve seen.

2. Bank or Brokered Certificates of Deposit

A certificate of deposit or CD, is a high-yield, long-term investment made with either a brokerage firm or a bank. A CD produces a higher yield compared to a savings account but requires investors to lock up their principal in the CD for a specified amount of time. This latter part is why CDs are riskier than savings accounts. Should interest rates rise while your principal is locked into a CD, you’ll pay a penalty in lost months of interest, if you liquidate the CD early.

3. US Treasury Inflation-Protected Securities

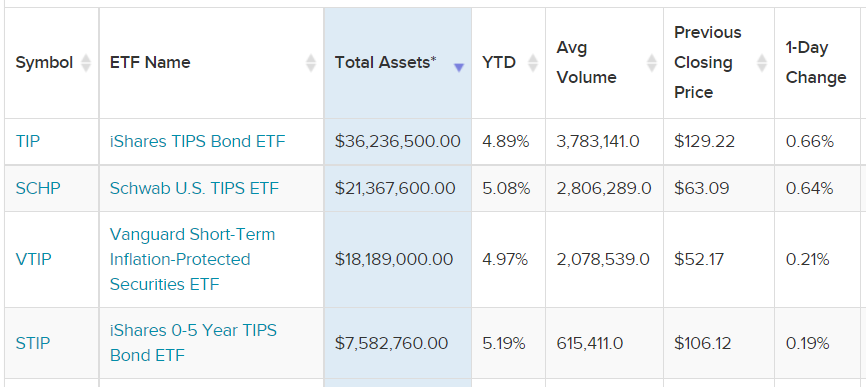

US Treasury Securities come in two varieties TIPS and I Bonds. These investments can keep pace with inflation and reduce your risk of loss of purchasing power. TIPS principal value changes along with inflation, so when inflation rises, you’ll receive the same interest rate but a greater interest payment which is paid on the larger principal value.

You can buy these securities on the Treasury Direct website or purchase inflation protected ETFs or mutual funds in your brokerage account. It’s also easy to sell an ETF or mutual fund. If you’re seeking an app to buy and sell ETFs and stocks you might consider one of my favorites, M1 Finance.

It’s important to understand that when you are seeking low risk investing, and purchase bond and inflation protected CDs, you will receive dividend payments, but that the fund’s value may rise or fall, resulting in capital gains or losses, when you sell.

4. Bond ETFs

Bond ETFs are funds that trade on the major market indexes. However, unlike funds that hold stocks, these ETFs hold portfolios of bonds. The main advantage of a bond ETF over individual bonds is its liquidity and diversification. When you buy a bond fund you receive a basket of diverse bonds and can sell at any time on the financial markets.

Bond ETFs come in many varieties including broadly diversified, corporate investment grade, government, high yield, international, municipal and more. Another benefit of bond funds is that they make regular dividend payments to owners and might also appreciate in value.

Bond investors need to understand the inverse relationship between a bond’s principal value and interest rates. When interest rates decline, bond principal values increase. Presently, it’s more likely that interest rates will hold steady or decline, than it is for an increase. That means you might expect not only cash flow, but price appreciation if you buy bonds in 2024.

Conversely, as interest rates rise, a bond or bond funds principal value will decline. Shorter term bonds and funds prices will vary less with shorter maturity bonds.

So, an additional risk of investing in bonds is the loss of principal, due to rising interest rates. Although, since bond funds will reinvest their interest payments in new issues, at the higher interest rates, over the long term, returns will surpass those of comparable individual bonds.

Individual investments in bonds, can protect your principal value, if the bond is held until maturity.

5. High-dividend Stock Funds

A high-dividend stock fund is an exchange traded or mutual fund that holds a portfolio of stocks paying dividends with high yields. Dividend Achiever funds include stocks of companies with a history of regularly raising their dividends.

As the portfolio of a high-dividend stock fund is composed of equities, you can expect the fluctuation of the principal invested in this asset to be high. Should the stock market take a tumble, then stock funds will likely drop in value more than bond funds. Currently, the Invesco Dividend Achievers ETF (PFM) mirrors the investments in the Nasdaq US Broad Dividend Achievers Index and yields 1.81%. Should the underlying stock prices decline, the dividend yield percent will grow, unless the dividends are cut.

6. Real Estate

Real estate, as an investment, gives investors access to a wide range of risk/reward profiles and can diversify a stock and bond portfolio. There are many types of real estate investments for the conservative income investor. You can buy property or become a shareholder as part of a group of investors. Real estate investment trusts (REITs) and real estate crowdfunding fall in the latter group.

REIT are types of funds. The real estate investment trust owns, operates or finances income-generating real estate. REITs come in many varieties from broadly diversified to niche real estate REITS which own storage facilities, commercial property, industrial, senior living facilities, student housing and more. The unique feature about REITs is that they are required by law to pay out 90% of their income to shareholders, making this a low-risk investment example for those seeking cash flow.

Real estate crowdfunding is a recent, modern approach to real estate investing, which allows you to directly invest with a real estate owner via a crowdfunding website. There are many types of real estate crowdfunding offers as well. Although, be aware that many real estate crowdfunding platforms require your cash to be tied up for longer periods.

Platforms like GroundFloor enable you to lend money to real estate investors and receive steady cash flow.

7. Target-date Funds

A target-date fund focuses on the time horizon of the investor above all else. The goal of a target-date fund is to optimize the risk/reward over the specified time horizon, with the fund’s risk declining over time. The stock and bond holdings of a target-date fund will begin with a greater percent invested in more volatile stock funds. As the target date approaches, the fixed or bond allocation of the fund increases as the stock proportion declines.

Investors typically invest in target-date funds for retirement, with their retirement year coinciding with the target year of the fund. But those with a shorter term goal, could use a target date fund for those goals as well. If you want a low risk alternative, invest in a target date fund with a target date five years away. The target date fund will have a conservative allocation with less risk than one with a longer time horizon.

FAQ

Why is a high-quality bond typically considered a lower-risk investment than a stock?

A stock offers no guarantee of a positive return on your investment, whereas a bond typically does. A bond is a loan to a government or corporation. A bond is a contract that entitles you to the coupon/interest payment and a return of your initial investment, at the bond’s maturity. Should a company go bankrupt, bondholders are typically eligible for repayment before stockholders.

What’s the difference between high-risk and low-risk investments?

The main differences between high-risk and low-risk investments are the degree to which your initial principal varies over time and the potential for loss of your initial investment. The lowest risk investments offer a near-guaranteed albeit small return, while high-risk investments offer no such guarantee and occasionally result in large profits. Overall, greater risk relates to a higher possibility of a loss and a greater magnitude of such a loss, should it occur.

When is a low-risk investment a good idea?

If you cannot take a large hit from a sudden drawdown in the market because you need money soon (read: You cannot reasonably hold the position, waiting for the recovery), a low-risk investment strategy is preferable. For example, the down payment cash for a home purchase should be in the lowest risk investment, because you want all of the cash to be available when you sign the purchase contract.

Older investors typically have lower risk tolerances for similar reasons – namely, having a shorter time horizon with which to invest – and thus should gravitate toward low-risk investments. In general, a longer time horizon equates to more time to recoup losses and for your investments to compound; likewise, those investors with shorter time horizons will find more benefit from employing low-risk investments like short term bond mutual funds and money market funds.

What are cash investments?

Cash investments or cash equivalents are those investments with similar properties to cash. Cash investments include CDs, money market mutual funds, and bank accounts. Cash and cash equivalent investments are important to own when you can’t afford to lose any of the principal value of your cash, ie emergency fund, home downpayment, or vacation fund.

Low risk investments tend to generate what kind of investment income and wealth?

Low risk investment returns usually vary with the market interest rates. Higher market interest rates align with higher CD and money market interest rates. When market interest rates are lower, then safe investments will generate lower levels of investment income and wealth.

You can use the Rule of 72 to approximate what type of investment return you’ll get from your low-risk investment. With a 5% interest rate, your money will double in approximately 14.4 years.

the Rule of 72 helps calculate approximately how long it will take for your money to double.

Number of years it takes to double your investment = 72/annual interest rate

What are safe stocks to invest in?

First, define what safe means to you. If safe means that your principal investment value will remain the same, then there are no safe stocks to invest in. But if you’re seeking stocks will less volatility and lower likelihood of corporate bankruptcy, that’s another question. Stocks such as utilities tend to provide higher dividends and less volatility. Some investors lean towards dividend stocks. A strong company balance sheet indicates a lower risk of company failure.

In general, if you’re looking for principal protection and secure value, you’re better off investing in CDs, Treasury bills, and money market mutual funds. But, if you have money that you won’t need for decades, such as for retirement, you’re likely to receive higher long-term growth by investing in stocks rather than cash. A good rule of thumb is to invest money that you’ll need in the next five to seven years in cash investments and moneys needed for the future can be invested in the stock market in a diversified mutual fund such as Vanguard’s Total Stock Market (VTI) index fund and a portion in a bond fund.

Which type of investment typically carries the least risk?

It depends on your definition of risk. If you consider a low risk investment, one that maintains its original value, then cash, money market mutual funds, and CDs are low risk investments. But if you define risk as the risk of running out of money in retirement, then there is a different answer. When investing for long term goals, such as retirement, you probably want to include some stock and bond funds in your investment portfolio. Although these assets have more volatile prices, over the long term, they are more likely to provide greater growth and higher returns leading to a greater likelihood that you will fulfill your financial retirement goals.

This post originally appeared at Barbara Friedberg Personal Finance.

Category: Personal Finance