This Is Where We’ll Find Winning Stocks (And Surging Dividends) In ’24

Let’s cut to the chase on dividend investing in 2024: our strategy this year will be all about interest rates.

Sure, there are other trends out there, like AI. And yep, there’s some steak behind the sizzle.

But when it comes to grabbing fast-growing—and high-yielding—payouts at the right times, rate moves will rule the roost. That’s not much of a surprise, really, as stocks have hung on Jay Powell’s every utterance for the last couple years.

But here’s the twist: Powell won’t be the headline-grabber in ’24. Look for him to fade into the background, with the Fed likely to move rates lower, maybe by a percent or so.

The real action will be at the “long” end of the curve, which not even Powell can corral. That would be the rate on the 10-year Treasury, which, like a petulant teenager, ignores—and outright defies—the Fed on the regular.

You only have to look back two-and-a-half months to see how “playing” a drop in the 10-year yield can pay off for us contrarian dividend buyers.

The 10-Year Yield’s “Autumn Plunge” Prompted Us to Buy …

Think back to late October. Back then, fear surrounded us. The narrative was that inflation was out of control, the Fed would keep hiking rates, and the 10-year Treasury yield was going to the moon!

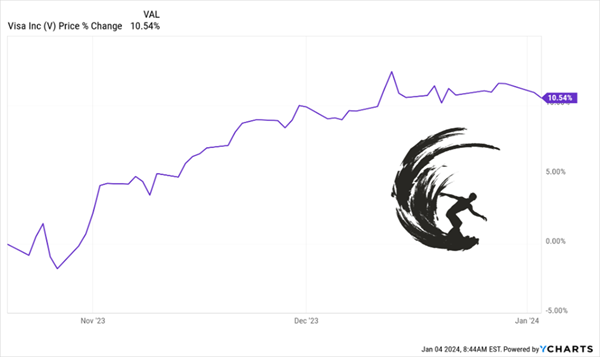

We contrarians called BS and added the “tollbooth of transactions,” Visa (V), to our Hidden Yields dividend-growth service. On cue, the 10-year Treasury yield broke south, plunging some 100 basis points. Visa? It soared:

Visa Rides Falling Rates to a Quick Double-Digit Gain

… And Today’s “Rate Breather” Has Us Making Our Shopping List

So where does that leave us? After bottoming around 3.8%, the drop in the 10-year Treasury rate has reversed, hence the pullback we’re seeing in the markets today.

Before we go further, let’s be clear on one thing: I expect more rallies in bond prices in 2024—which would drive bond yields back down—and put a further lift under our favorite dividend payers.

While we wait for that to happen, we’re making our shopping list, starting with the three sectors below. When it’s time to jump on them, I’ll give you the signal, and the exact tickers to grab, in Hidden Yields.

Oil: Set to Power Into 2024

When it comes to early 2024 dividend buys, the thing to remember is that the fall rally didn’t include everything: energy stocks weren’t invited to the party, as crude dropped below $70 a barrel (it’s around $73 today).

But there’s plenty of reason to expect a further bounce, in part because of something we don’t hear much about these days: the US Strategic Petroleum Reserve (SPR), a crude stockpile that’s supposed to be held for emergency use only.

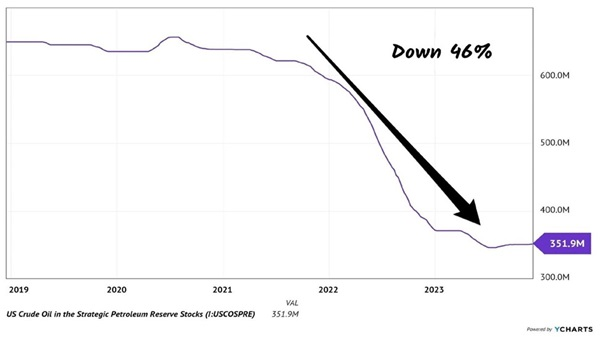

SPR Now Light on the “Reserve” Part

Over the past couple years, we’ve used 300+ million barrels. The “emergency” was inflation! I suppose it worked, but our rainy-day Texas Tea fund is down by nearly half.

And now, with oil cheap, our elected officials can buy low. In practice, I’d be shocked if that happened in an election year. Uncle Sam as a buyer drives up the price. No bueno for voters.

Still, the SPR is more or less tapped out for the time being. Uncle Sam can’t keep this pace up because there’s only so much left. With a big supplier off the market, crude has a catalyst for higher prices. Supply is down, so… (fill in the Econ 101 blanks!)

Bullish for oil—especially for domestic shale producers like EOG Resources (EOG), which owns more federal drilling permits than any other firm. EOG is the No. 1 producer in the Permian Basin, known for its top-quality reserves and favorable fracking landscape.

EOG yields 2.9% and sells at just 9—nine!—times forward earnings. That’s a steal for a dividend grower like this, whose quarterly payout has bounced tenfold in the last decade, from $0.09 quarterly to $0.91 today, not to mention a raft of special dividends—eight, by my count—just since mid-2021.

… While “Bond Proxy” Utilities Will Roll in the Long Run

While energy was left behind last fall, utilities were not. As usual, our fav “recession-resistant” plays traded inversely to bond yields, as they have since, well, forever.

Falling Treasury yields sent utilities soaring in late 2023, and, like bonds and real estate investment trusts (REITs)—more on those below—they’re due for a pause here.

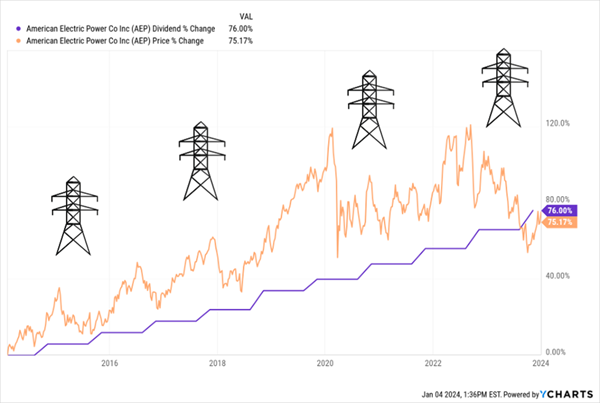

That’s a good opportunity for us to take stock of firms like American Electric Power (AEP), which boasts some 5.6 million customers across 11 states. It also boasts a high current yield—4.2%—and steady dividend growth that’s pulling the share price higher, a phenomenon I call the “Dividend Magnet”:

AEP’s Dividend Charges Up Its Share Price

Meantime, AEP continues to simplify its business, closing the sale of its 1,365-megawatt renewables portfolio last summer (for $1.2 billion) and moving ahead with sales of other non-core assets.

One thing I love about these moves is that management is dropping the proceeds onto AEP’s debt load, which fell from a peak of $44 billion at the end of the second quarter to $42.2 billion by the end of the third. That’s a reasonable 44% of assets. And of course, declining interest rates will further cut AEP’s borrowing costs.

We can expect dividend growth to continue, too, with the payout accounting for 64% of the midpoint of AEP’s forecast full-year 2023 earnings.

That’s comfortable for a steady revenue generator like AEP. And with management calling for long-term yearly earnings growth of 6% to 7% (in line with Wall Street’s forecast for 2024), we can look forward to a continued drumbeat of yearly hikes.

Select REITs Are Smart “Buy the Dip” Plays, Too

REITs have taken a hit in the last couple years, as investors worried that higher rates would boost their borrowing costs.

At the same time, REITs’ high dividends (thanks in part to their exemption from corporate taxes, as long as they pay out 90% of their earnings as dividends) faced more “payout competition” for investors from Treasuries.

That trend shifted into reverse in late 2023, as rates fell. But as with bonds and utilities, we expect a pause here. Perfect for us! We can get our lists ready for the next bounce.

Where are we looking? Well, we don’t want anything to do with office REITs like Alexandria Real Estate Equities (ARE). It’s not that I think these are bad companies; I just worry that the shift toward work-from-home and, more recently, hybrid options, has slashed demand for office space to the point where these REITs’ business models may be obsolete.

Instead, just like our Visa pick, we like “tollbooth” plays, which simply charge a rate to use their pipelines, networks or whatever. Cell-tower REIT Crown Castle International (CCI) makes a lot of sense because no matter what happens with the economy, Americans will not cut back on their cell phone use!

Also, select residential REITs, like Essex Property Trust (ESS), which we discussed in our January 2 article, are nicely positioned for 2024, as high home prices continue to keep first-time buyers in the rental market.

Moreover, Essex’s focus on the Bay Area makes it a good play on rising investment in areas like AI while still letting us draw a decent income (Essex yields 3.8% and has grown its payout 91% in the last decade).

Introducing My “Made for 2024” Dividend Portfolio

I know I don’t have to tell you that COVID changed the game, ushering in the inflation and soaring interest rates we’ve all been dealing with these past couple of years.

But the wind is (finally!) shifting: high rates are on the way out, setting us up to grab growing dividends and upside with stocks like AEP, Essex and the others we talked about above.

They’re just the start. My “2024 Portfolio” is built to give us even bigger, and faster-growing, payouts! The 5 stocks in this time-sensitive portfolio are bargains, setting us up for swift price upside, too!

And if we do get a pullback, that’s fine: these 5 names have the “storm-proof” sales they need to grow their earnings (and share prices) and keep our dividends flowing.

I don’t want you to go into it uninformed, so I urge you to click here, and I’ll share my full dividend strategy for the surprising shifts ahead. You’ll also discover how to download a FREE Special Report naming the 5 powerful dividend growers I just mentioned, including my latest research on each one. Don’t miss this chance to get in early!

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks