Unlocking Opportunities: A Guide To Undervalued Stocks

Undervalued stocks are shares that are currently priced lower than their intrinsic value. Investing in undervalued stocks can offer several benefits.

Investing in undervalued stocks provides an opportunity to buy quality stocks at a discounted price, maximizing potential returns in the long run. Common indicators of undervalued stocks include low price-to-earnings ratios, high dividend yields, and strong fundamentals.

Case studies of successful investments in undervalued stocks demonstrate the potential for substantial gains when buying at a discount. However, trading undervalued stocks is not without risks and challenges. There is a possibility that the stock may remain undervalued or even decrease further in value.

Identifying undervalued opportunities requires thorough research and analysis. Despite these risks, investing in undervalued stocks can be lucrative over time as they have the potential to appreciate once market conditions improve and their true worth is recognized by investors.

How Can I Identify Undervalued Stocks?

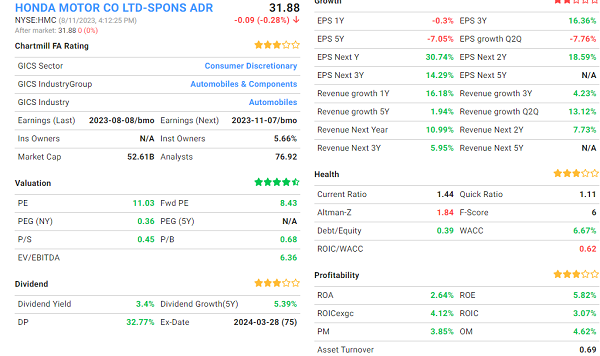

One way to identify undervalued stocks is by analyzing their financial ratios and comparing them to industry benchmarks. By evaluating the intrinsic value of a stock, you can determine whether it is trading below its true worth.

Analyze Financial Statements

Start by thoroughly examining a company’s financial statements, including its balance sheet, income statement, and cash flow statement. Look for signs of strong performance and consistent growth.

Utilize Valuation Ratios

Use valuation ratios such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to assess the relative value of a stock compared to its peers in the industry.

Consider Market Trends

Stay updated on market trends and news that may impact the stock’s value. This includes monitoring industry developments, competitive landscape changes, and macroeconomic factors.

Why Do Stocks Become Undervalued?

There are several reasons why a stock may be undervalued in the market. Market factors play a significant role in determining the value of stocks. For example, if there is negative news or uncertainty surrounding a particular industry or company, it can lead to a decrease in investor sentiment and consequently undervaluation of stocks.

Economic conditions also influence stock prices. During an economic downturn, investors may be cautious and sell off their holdings, leading to undervaluation of stocks. Also, poor financial performance or industry trends that indicate potential challenges for a company can cause its stock price to fall below its intrinsic value.

What Strategies Can I Use To Trade Undervalued Stocks?

When looking to trade undervalued stocks, it’s important to consider various strategies that can help maximize potential gains.

Here are three key strategies you can use:

Value Investing: This strategy involves identifying stocks that are trading below their intrinsic value. By conducting thorough fundamental analysis, you can uncover companies with strong financials and growth prospects that the market has overlooked.

Price to Earnings Ratio (P/E): The P/E ratio compares a company’s stock price to its earnings per share. A low P/E ratio may indicate an undervalued stock, as investors may not fully appreciate its earning potential.

Dividend Yield: Pay attention to companies that offer high dividend yields relative to their stock price. This indicates that the company is distributing a significant portion of its profits as dividends, making it an attractive investment option for income-focused investors.

Difference Between Undervalued And Overvalued Stocks?

The difference between undervalued and overvalued stocks can be understood by comparing their respective intrinsic values to their current market prices.

Undervalued stocks are those whose intrinsic value is higher than their current market price, suggesting that they may be trading at a discount.

On the other hand, overvalued stocks are trading above their intrinsic value, indicating that they may be priced too high.

Determining whether a stock is undervalued or overvalued requires careful analysis using various metrics and fundamental analysis techniques. It is also important to consider market sentiment and potential market manipulation when evaluating stock prices.

Are Undervalued Stocks Suitable For Short-Term Traders?

Undervalued stocks may not be ideal for short-term traders due to the potential need for a longer holding period to realize their full value. While these stocks offer opportunities for long-term investors, they come with their own set of pros and cons.

It’s important to consider the following:

- Pros of trading undervalued stocks:

- Potential for significant future gains as market sentiment improves.

- Ability to buy quality stocks at a discounted price.

- Long-term investment strategy can lead to substantial returns.

- Cons of trading undervalued stocks:

- Volatility in the short term due to external factors like economic conditions or industry performance.

- Market sentiment plays a crucial role in determining stock value, making it unpredictable.

- Common misconceptions about undervalued stocks can deter some investors from exploring this opportunity.

Understanding the impact of market sentiment and external factors on the short-term performance of undervalued stocks is vital for any investor considering this strategy.

How Can Industries Impact Stock Undervaluation?

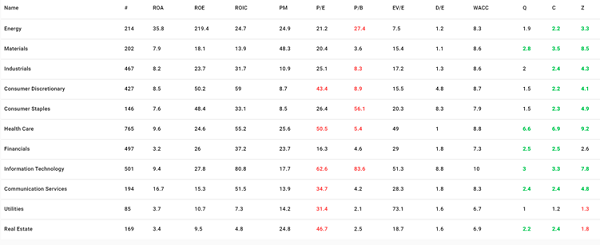

Different industries may experience varying levels of investor sentiment based on their financial indicators.

Market conditions play a significant role in determining whether an industry is undervalued or not. During a bear market, most sectors tend to be undervalued due to overall pessimism in the market. Conversely, during a bull market, sectors may become overvalued as investor sentiment becomes overly optimistic.

Sector performance also influences stock undervaluation.

Industries showing strong growth potential and positive financial indicators are more likely to attract investors’ attention and drive up valuations. Sectors facing challenges or experiencing declining financial indicators may be undervalued.

What’s The Efficient Market Theory And Relation To Stock Valuation?

Understanding the efficient market theory and its relation to stock valuation can provide valuable insights for investors.

The efficient market theory states that “financial markets are efficient and incorporate all available information into the stock prices”. This means that any new information, such as earnings reports or economic data, is quickly reflected in the stock price, making it difficult for investors to consistently outperform the market.

Market efficiency does not imply that all stocks are fairly valued at all times. Market anomalies can occur due to various factors, such as investor sentiment or behavioral biases. These anomalies create opportunities for savvy investors to identify undervalued stocks and potentially earn higher returns.

Frequently Asked Questions

How Can I Analyze the Financial Statements of a Company to Identify Undervalued Stocks?

To identify undervalued stocks, analyze a company’s financial statements using techniques like financial ratios. Conduct fundamental analysis to evaluate the company’s performance and prospects. This will help you make informed decisions based on value investing principles and stock valuation methods.

What Are Some Common Indicators or Metrics That Investors Use to Identify Undervalued Stocks?

To identify undervalued stocks, investors commonly use indicators such as fundamental analysis, price to earnings ratio, dividend yield, book value, and market capitalization. These metrics help assess a stock’s potential for future growth and profitability.

Are There Any Specific Industries or Sectors That Tend to Have a Higher Probability of Undervalued Stocks?

In emerging markets, contrarian investing can uncover undervalued stocks. Small cap stocks in cyclical industries often present opportunities for value investing strategies. These sectors typically have a higher probability of finding undervalued stocks.

Can Market Sentiment or Investor Psychology Play a Role in the Undervaluation of Stocks?

Market sentiment and investor psychology can indeed influence the undervaluation of stocks. Behavioral biases and market inefficiencies often lead to mispricing. Understanding these dynamics is crucial for value investing strategies.

What Are Some Potential Risks or Challenges Associated With Investing in Undervalued Stocks?

When investing in undervalued stocks, you should be aware of potential risks. Market volatility can affect the value, while liquidity concerns may limit your ability to sell. Lack of information and timing challenges can also impact your investment decisions.

Conclusion

Identifying undervalued stocks requires thorough research and analysis and the strategies outlined are a great start. A diamond in the rough shines brighter once polished, these undervalued stocks have enormous potential for growth. But there’s also the potential of the stocks staying undervalued.

As with all trading, due diligence is an important step all traders should take before tackling the stock market.

This post originally appeared at NetPicks.

Category: Stocks