Is It Time To Buy Financial Data Stocks?

The stock market has been rocky so far in 2026.

It feels like every day stocks are either really red or really green.

One industry likely wishes it behaved more like the overall market.

The past year for financial data stocks has been miserable.

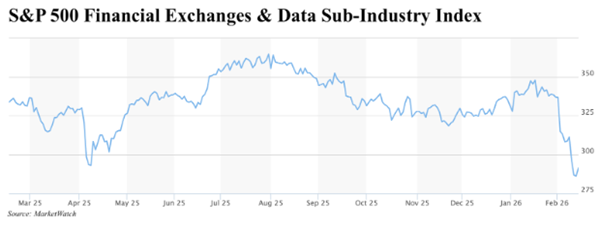

The above index is down more than 25% over the past year.

I used to work in the industry, so it’s really interesting to me.

And it should be interesting to you.

Usually, when the stock market does well, these financial data stocks rise with it.

But the S&P 500 is up almost 15% over the last year, so what’s going on?

Anthropic, creator of Claude, an AI assistant, just announced major improvements for its AI product.

In particular, Claude’s latest update allows the AI to do financial analysis.

You can read Anthropic’s press release here.

Fears about AI making these financial data companies obsolete are crashing their stocks.

And the losses accelerated with Anthropic’s news.

But is the market overreacting to AI?

All of these companies sell financial data and software to professional investors to help make investing decisions.

Portfolio managers, investment bankers, and hedge funds all pay billions of dollars every year to these companies to get the best data or fastest software.

If AI could provide the same products and services, and do it cheaper, financial data companies are going to lose many of their customers.

But AI is overhyped here, and now is an amazing buying opportunity for some of these financial data companies.

AI might be able to replace what these companies provide, but it’s going to need a ton of computing power and energy to do it.

I don’t believe energy production or chip improvements will be able to keep up with the demand.

Plus, some of these companies have huge data sets going back decades.

Even if AI tried to replace these companies, a lot of the sourced materials from the 70s and 80s are only on paper.

These are some of the best financial data stocks right now.

First up is Morningstar (ticker: MORN), a financial data and research firm.

Morningstar is the gold standard when it comes to financial data, especially related to mutual funds.

I get a limited Morningstar subscription through my public library and I use it constantly.

Morningstar’s 23.7% return on equity (ROE) is one of the highest in the industry.

And its current price-to-earnings ratio of 17.4x is at its lowest point since 2008.

If you’re still worried about AI, then S&P Global (ticker: SPGI) is a great pick.

Its stock price is down almost 25% in just the month of February.

While S&P Global does have financial data and software, it makes the majority of its money rating bonds and market research.

AI won’t be replacing those anytime soon (or at all)!

Over the past decade, S&P Global’s revenue has averaged almost 10% growth each year.

And S&P Global’s 29% profit margin is double the industry average.

MSCI (ticker: MSCI) is a little more expensive than the others on the list, but it’s incredibly profitable.

MSCI is the top provider of indices for portfolio managers to judge their portfolios against.

Like other financial data providers, MSCI has had a terrible February.

Its stock price is down almost 20% over the last few weeks.

But MSCI’s profitability is insane.

Its profit margin of 38% is one of the highest around.

MSCI’s price-to-earnings ratio of 32x is low historically, but a little expensive relative to other financial data companies.

However, MSCI’s return on assets (ROA) of 22% is the highest in the industry and the all-time high for the company.

Are you buying the dip on any financial data stocks?

Coach Parker

Category: Stocks