An Investment That Protects Against Stock Market Crashes…With A 14% Yield!

The stock market’s a mess, right?

Recession fears, uncertainty with tariffs, political conflicts with our NATO allies.

There is so much for everyone to worry about RIGHT NOW.

I am worried about a stock market crash.

Good news, the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (ticker: TLTW) will help you sleep better at night.

TLTW uses a covered call strategy on treasury bonds to generate income for you.

That sounds pretty confusing, so let’s break it down.

TLTW buys shares in iShares 20+ Year Treasury Bond ETF (ticker: TLT).

TLT is a simple fund that purchases long-term treasury bonds.

A covered call strategy is when you purchase a stock (or in this case, an ETF) and sell an option to another investor. The option obligates you to sell the stock in the future at a certain price. In exchange you collect a premium.

The premium is cash flow that is then distributed to shareholders as dividends.

And man… do they pay out fat dividends!

TLTW’s dividend yield is currently 14%!

Even better – they pay out every single month of the year!

Why is the dividend yield so high?

TLTW has two sources of income:

- premiums from the call options and

- bond interest

Because the TLT ETF owns bonds, TLT yields 4% by itself, which TLTW collects and passes on to us shareholders.

Now, how do we also get protection from stock market crash?

When you see weakness in the economy, stocks fall. This creates a flight to safety – investors rush to buy bonds. This drives UP the price of the bond.

PLUS, as the economy weakens, central banks often lower interest rates… lower rates drive up the value of bonds as well.

Falling interest rates help bonds because higher yielding bonds are in more demand, which drives up their price.

So if you see economic weakness… or expect the market to falter – like it has been for the last several weeks… Investments like TLTW will help cushion your investments.

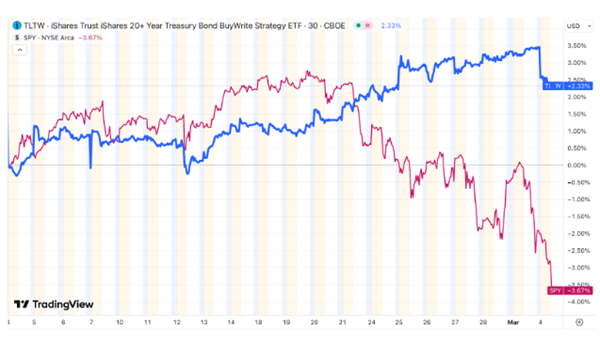

You can see this relationship over the last month between TLTW and the S&P 500.

Once the stock market started to fall in mid-February TLTW began to move higher.

There is a downside to covered call strategies. You give up some potential gains by selling the call options. This is really exacerbated by very quick movements… a slow and steady move higher can be really good!

Now you’ll find this interesting… TLT is actually performing better than TLTW this year.

But the yield of TLT is only 4%.

We can get 3x as much in yield by investing in TLTW.

I want to know… do ETFs like TLTW make you feel better about investing in a kangaroo market?

Or do you just buy standard old bonds?

I’m very curious about your thoughts – so send us a quick note!

This post originally appeared at Dividend Stocks Research.

Category: Dividend Stocks