How Trump’s Policies Could Boost Small Cap Stock Growth

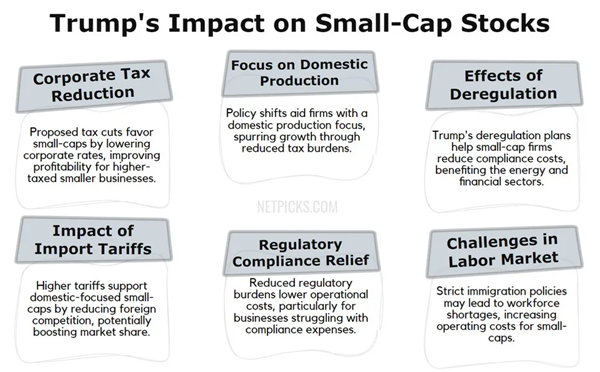

If you’re considering the impact of Trump-era policies on your investment strategy, you’ll want to pay attention to small-cap stocks. These companies, often overlooked in favor of their larger counterparts, stand to gain substantially from proposed corporate tax cuts and deregulation measures.

While large corporations have already optimized their tax strategies, smaller firms typically pay higher effective rates – meaning they’ve got more to gain from reforms. But tax benefits are just the beginning of what could make small caps the dark horse winners in this economic climate.

TLDR

- Corporate tax cuts from 21% to 15% particularly benefit small caps, which typically pay higher effective tax rates than large corporations.

- Deregulation initiatives reduce compliance costs, especially benefiting small-cap companies in the energy and financial sectors.

- Import tariffs of 10-20% protect domestic-focused small caps from foreign competition, as they primarily operate within U.S. markets.

- Small caps historically demonstrate stronger recoveries during economic expansions and respond more vigorously to business-friendly reforms.

- Reduced regulatory barriers create growth opportunities for small caps in manufacturing, technology, and consumer discretionary sectors.

Trump’s Economic Plans: Impact on Small Caps

Under Trump’s proposed economic policies, small-cap stocks could see significant changes in their performance and market positioning.

The economic outlook for these companies looks to be favorable, particularly due to proposed tax cuts that would lower corporate rates from 21% to 15% for domestic production. Since small caps typically pay higher effective tax rates than large corporations, they’d benefit more from these reductions.

You’ll want to pay attention to the regulatory environment, as Trump’s deregulation plans could significantly benefit small caps. These companies often struggle with compliance costs, so reduced regulations, especially in the energy and financial sectors, would help their bottom line.

When it comes to trade dynamics, Trump’s proposed import tariffs of 10% to 20% (and up to 60% on Chinese goods) might help domestic-focused small caps by reducing foreign competition.

However, you should consider the labor market implications. Trump’s strict immigration policies could create workforce challenges for small caps, potentially increasing their operating costs.

This is especially important if you’re looking at labor-intensive sectors where these companies might face staffing shortages and higher wages (retail, construction, agriculture…).

Small Cap Performance During Similar Policy Periods

When we look at similar policy periods in the past, small caps have shown impressive historical performance during times of business-friendly reforms. Similar to how swing trading strategies can capture larger price movements in volatile markets, small caps tend to exhibit more dramatic price swings during changes in government policy.

You’ll notice a consistent pattern of small-cap outperformance during post-recession recovery phases, as these companies tend to bounce back “easier” when economic expansion takes hold.

“Small caps have bested large caps coming out of nine of the last ten recessions, with the outperformance beginning roughly halfway through the recession and lasting about a year after it ends.” – Anchor Capital

During previous periods of tax cuts, like those in the early 2000s and Reagan era, small caps benefited significantly due to their domestic focus. The tax implications of such policies often have a more direct impact on smaller companies’ bottom lines.

Interest rate trends have also played a big role. When rates decline, small caps typically perform well since they rely heavily on borrowed money to fuel growth.

They’ve also shown resilience during moderate inflation periods, as they can often adjust prices more quickly than larger companies.

While past performance doesn’t guarantee future results (especially in trading), these historical patterns suggest that small caps could thrive under similar policy conditions.

Small Cap Risks Under Trump’s Economic Agenda

As Trump’s economic policies roll out, small-cap stocks face several challenges that investors must consider. The biggest concerns are around inflation effects and interest rate impacts, which could make it harder for smaller companies to manage their debt and operating costs.

Here’s a breakdown of key risk factors affecting small-cap stocks:

| Risk Category | Impact | Strategy |

|---|---|---|

| Inflation | Higher costs | Improve pricing power |

| Interest Rates | Increased debt expense | Reduce reliance |

| Supply Chain | Disruption risks | Diversify suppliers |

| Trade Policy | Market access issues | Focus on domestic market |

One big risk is supply chain vulnerabilities, as smaller companies often have less diverse supplier networks. Trade retaliation risks could hit small caps particularly hard since they typically lack the resources to quickly adjust their business models. Market volatility factors also tend to affect small caps more severely than larger companies.

Remember that while these companies might benefit from some of Trump’s policies, they’re also more susceptible to economic shocks. It’s smart to diversify your portfolio and maintain a long-term outlook when investing in small caps during this period.

Small Cap Sectors Poised for Trump Policy Gains

Through Trump’s proposed economic policies, several small-cap sectors could be ready for significant growth opportunities. If you’re looking to invest in small caps, understanding which sectors might benefit most can help you make informed decisions.

Consider using the trend identification approach with technical analysis tools like EMAs can help validate sector momentum before investing.

Financial deregulation benefits could give small-cap banks and financial firms a boost by reducing their compliance costs and opening up new opportunities for mergers.

In the energy sector, you’ll find potential growth as Trump’s lighter regulations might help smaller oil and gas companies cut operational expenses and expand their operations.

You’ll want to watch the industrial manufacturing boost, as small-cap manufacturers could thrive under policies promoting domestic production.

With tax cuts putting more money in consumers’ pockets, you might see increased consumer spending benefit small retailers and service providers in the consumer discretionary sector.

Don’t overlook technology innovation potential, either. Small-cap tech companies could see growth opportunities as regulatory barriers decrease, especially those working in emerging technologies.

These companies often have the flexibility to adapt quickly to new market conditions and capitalize on policy changes.

Small Caps: Policy Responses

The distinctive nature of small-cap stocks creates unique opportunities when economic policies change. Several key characteristics make these stocks particularly responsive to changes in economic policy, which can work to your advantage when making investment decisions.

| Characteristic | Description |

|---|---|

| Growth Potential | Small-cap stocks have significant growth potential as they start from a smaller base, allowing for quicker expansion compared to larger companies. |

| Market Sensitivity | They are highly sensitive to economic changes, often reacting more strongly during recovery periods, which can lead to greater volatility in both upward and downward movements. |

| Domestic Focus | Small-cap companies typically conduct most of their business within the U.S., making them directly affected by local economic policies. |

| Sector Exposure | Many small caps are concentrated in industries like industrials and materials, which respond strongly to policy changes, enhancing their growth opportunities. |

| Policy Impact | The impact of economic policies on small caps is pronounced, as these companies can quickly adapt to new conditions and capitalize on opportunities such as tax cuts or increased government spending. |

First, small-cap stocks have significant growth potential because they’re starting from a smaller base. When favorable policies are implemented, they can expand more quickly than their larger counterparts. Their market sensitivity means they’ll often react more strongly to economic changes, especially during recovery periods. You’ll notice this heightened responsiveness in both upward and downward market movements.

Another important feature is their domestic focus. Since small-cap companies typically do most of their business within the U.S., they’re directly affected by local economic policies.

Their sector exposure also plays a role, as many small caps are concentrated in industries like industrials and materials, which respond strongly to policy changes. The policy impact on small caps is generally more pronounced because these companies can adapt quickly to new economic conditions and take advantage of policy-driven opportunities, such as tax cuts or increased government spending.

Your Questions Answered

How Do International Trade Tensions Specifically Affect Small-Cap Versus Large-Cap Performance?

When you’re comparing trade uncertainty impacts, small caps often face less exposure to international tensions than large caps.

That’s because they’re typically more focused on domestic markets. The analysis will show that large caps tend to take bigger hits during trade disputes since they rely heavily on global supply chains.

Small-caps’ domestic focus can act as a buffer, though you’ll want to consider sector diversification benefits for better economic resilience.

What Percentage of Small-Cap Companies Typically Benefit From Corporate Tax Cuts?

You’ll find that around 60-80% of small-cap companies typically see direct benefits from corporate tax cuts, as they’re often more focused on domestic business.

When tax rates drop, these companies can reinvest more of their profits, spurring economic growth.

Market conditions tend to improve as investor sentiment strengthens, since small caps usually have higher effective tax rates than large caps, making them bigger winners when taxes are reduced.

Should Investors Adjust Their Small-Cap Allocation During Different Phases of Trump’s Term?

You’ll want to adjust your small-cap allocation based on investment timing and economic indicators throughout Trump’s term.

Watch how his policies are implemented and their market impact. Consider sector rotation as different industries respond to new regulations.

Don’t forget about risk management – maintain proper portfolio diversification rather than going all-in on small-caps.

How Do Small-Cap ETFS Compare to Individual Stock Picking in Trump’s Policy Environment?

When you’re choosing between small-cap ETFs and individual stock picking, ETFs offer you broader diversification and lower risk during Trump’s policy changes.

While picking individual stocks might give you higher potential returns, you’ll need more time for research and can face greater volatility.

ETFs provide an easier way to gain exposure to the small-cap sector, with professional management handling the stock selection and rebalancing for you.

What Indicators Show When Small-Caps Might Be Overvalued in This Policy Climate?

You’ll want to watch several key indicators for small-cap overvaluation.

Keep an eye on valuation metrics like P/E ratios that are running well above historical averages.

If earnings guidance from multiple companies starts trending downward while stock prices keep rising, that’s a red flag.

Also monitor market sentiment for excessive optimism, rising interest rates that could hurt small-cap borrowing costs, and economic indicators showing a potential slowdown in domestic growth.

Conclusion

You’ll find small-cap stocks offer unique opportunities under Trump’s policies, but they require careful consideration. While tax cuts and deregulation could boost their performance, don’t forget to weigh the risks. Consider diversifying your portfolio and watching market trends closely. If you’re thinking about investing in small caps, focus on sectors that’ll benefit most from domestic growth and reduced regulations.

This post originally appeared at NetPicks.

Category: Stocks