A Golden 4x Dividend Hike

I’ve seen some companies with amazing dividend growth.

But a mining company just did something I’ve never seen before.

We’ll get to it in a minute.

Mining stocks have gone crazy in the last year.

The price of gold is really driving the stock price gains for some of these mining companies.

In the last 5 years, the price of gold has gone up over 240%.

The S&P 500 hasn’t even doubled over the same time frame!

When the price of gold goes up so much, it means mining companies are making more money.

And one mining stock is giving some of its extra money back in dividends.

Barrick Mining (ticker: B) is one of the largest gold miners in the world.

It mined over 3.25 million ounces of gold in 2025, making Barrick the second largest gold miner.

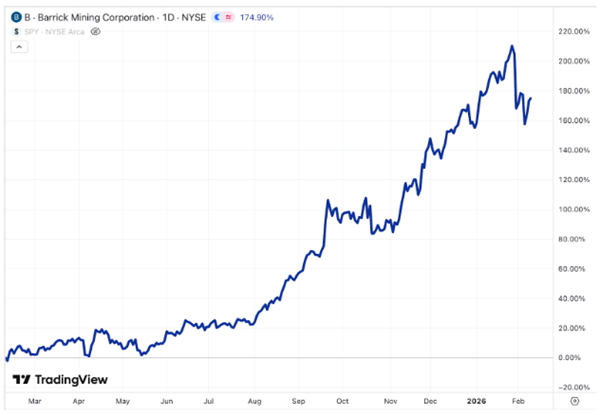

Similar to the price of gold, Barrick’s stock price is going through the roof.

At one point, Barrick was up over 200% since last February.

Barrick’s investors have been really happy with their gains.

They’re going to be even happier with a massive dividend hike.

Barrick announced it’s raising its dividend to $0.42, which is more than 4x higher than the $0.10 dividend Barrick paid last February.

If you want Barrick’s next dividend payment, you need to act quickly.

You need to own stock in Barrick by February 26 (Thursday) to get the higher payment.

The increase raises Barrick’s dividend yield to 3.5%, which is an all-time high.

You also won’t find many other mining companies with a higher dividend yield.

Does the increase mean we should be expecting massive dividend growth going forward?

Not so fast!

Barrick is changing how it’s paying dividends.

Before, Barrick paid $0.10 every quarter and sometimes paid more based on the amount of cash the company held.

However, starting with its next dividend, Barrick has a new dividend policy.

Barrick will pay $0.175 every quarter as well as 50% of its free cash flow.

Here’s a press release describing the new dividend policy.

It’s really important to understand what Barrick is doing.

If gold prices continue to rise, Barrick will make more money and pay out higher dividends.

If the price of gold falls or stagnates, Barrick won’t be making as much money and the dividend payments will fall.

Barrick’s dividend is now a variable dividend with payments changing every single quarter.

But the dividend won’t fall below $0.175.

If you need a stable dividend every quarter, then Barrick isn’t for you.

The dividend can change a lot from quarter to quarter!

But if you don’t mind your dividend check changing, Barrick Mining is a great mining company to collect some cash.

What mining stocks do you own?

Michael Jennings, Editor

This post originally appeared at Dividend Stocks Research.

Category: Dividend Stocks