The Steadiest Dividend Stocks Paying Up To 11%

Worried about a pullback? I don’t blame you.

Today we’ll discuss five of the steadiest dividend stocks on the planet. And let’s not confuse stability with penny pinching—these cash cows yield up to 11%!

How do we capture payouts without wild price swings? Two words: low beta.

Beta measures how much (or how little) a stock or fund moves compared to a benchmark—usually the S&P 500, but it depends. The benchmark is set at 1. Lower than 1 means an investment moves less; higher than 1 means it moves more.

Thus, beta is a de facto measure of an investment’s volatility. Low-beta stocks move less than the broader market.

Here’s an easy-to-understand example:

Let’s say a stock has a beta of 0.50. That means, broadly speaking, when the S&P 500 drops by 1% in a day, the stock will probably only drop by 0.50%.

This information won’t help you at all on a day-to-day basis. Even the lowest-volatility stocks can suffer the occasional jolt. But once you start measuring in years instead of weeks, you’ll see just how much calmer low-beta stocks are by comparison.

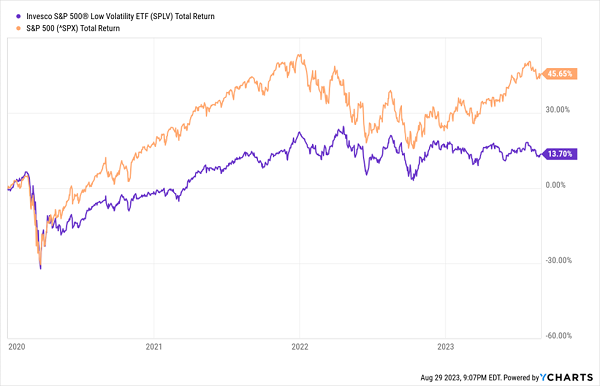

For Better or Worse, Fewer Bumps in the Road

Just remember: Low-volatility stocks can get left behind during market upswings, too. So we need to get greedy—we want high-yielding, low-beta, and high-potential stocks that can climb higher over time, rain or shine.

Let’s look more closely at a five-pack of 5.0%- to 10.8%-yielding stocks—which, by beta, are half as volatile as the market, or less!—to see whether any fit the bill.

Trustco Bank

Dividend Yield: 5.0%

1-Year Beta: 0.50

Once in a while, big banks will serve up big yields, but you’ll typically have better luck finding 5%-plus yields from regional financial stocks like Trustco Bank (TRST).

Trustco Bank is a small mid-cap regional bank founded more than a century ago in Schenectady, a city in upstate New York. It underwent a big expansion in 2002, and it now boasts 140 branches across downstate New York, New Jersey, Massachusetts, Vermont, and—um—central Florida.

Trustco, like just about every other regional, was pounded earlier this year after the Signature Valley Bank (SVB) mess.

Same Trend Lower, Just Less Violent

The selling here might be a touch overdone. Trustco, which has a low beta of 0.50, has equally steady financials. Net interest income barely dipped during the pandemic, and it has been on a slow upward climb in the couple of years since. The payout ratio is just fine, at 37%, so the ample payout should survive even if profitability retreats a bit next year. Dividend increase activity could tell us a lot—keep an eye on TRST around mid-November, when Trustco would be likely to announce a payout hike, if one’s coming.

Safety Insurance Group (SAFT)

Dividend Yield: 5.2%

1-Year Beta: 0.49

Safety Insurance Group (SAFT) is an A.M. Best “A”-rated insurer that provides auto, home and business owner’s insurance in Maine, Massachusetts and New Hampshire. Specifically, a little more than half of its 2022 direct written premiums were private passenger automobile insurance; homeowners policies were another quarter; property and casualty (including commercial automobile) were 17%; and dwelling fire, umbrella and business owner properties made up the rest.

You’ve heard everyone cry “inflation!” this year, but believe it or not, auto insurance has one of the loudest gripes. Of all expenditures tracked by the Bureau of Labor Statistics, car insurance premiums saw the biggest increase between June 2022 and June 2023—a whopping 16.9%! Safety Insurance literally can’t raise its policy premiums fast enough, which has dogged its results—its combined ratio was 101.9% (it paid more in claims than it collected in premiums) in the second quarter, fueling a non-GAAP operating loss and an earnings miss.

Shares of this normally cool cucumber have not responded well.

Safety Is Usually a Safe Play, But 2023 Has Been Dreadful

If there’s any saving grace, it’s that SAFT typically dwells in a smoother area of the insurance space. P&C (a minor part of Safety’s business) can be much more volatile thanks to natural disasters and other catastrophes. Still, it’d be nice to see more upward pressure on the dividend, which has been stuck at 90 cents per quarter since 2019.

Omega Healthcare Investors (OHI)

Dividend Yield: 8.3%

1-Year Beta: 0.47

Omega Healthcare Investors (OHI) is a triple-net lease real estate investment trust (REIT) firm that provides financing and capital solutions to operating partners in the skilled nursing facility and assisted living facility industries.

It’s also the best 2023 performer of all the stocks on this list, marching roughly in line with the broader market and, more importantly, kicking the pants off the real estate sector.

OHI Is Being Nursed Back to Health

While REITs have long since reclaimed (and re-lost) their COVID highs, Omega’s rebound has been slower—and came from a much deeper bottom. Like the rest of its industry, OHI was hammered during the pandemic thanks to COVID’s outsized toll on nursing homes and assisted living.

Omega has been recovering in roller-coaster fashion ever since, but never quite able to bust through its 2020 highs thanks to lingering issues from the pandemic.

Still, a few months ago, I said:

Those with patience might prevail. Omega still has a healthy balance sheet, and the business is finally seeing some light at the end of the tunnel. OHI has concluded with a series of restructurings, and rent is flowing in from those tenants once more. … A brisk takeoff ahead? Maybe not. But most of Omega’s problems are no longer on the horizon, but in the rear-view mirror.

OHI has delivered another few percentage points of gains since then while maintaining a steady-Eddie pace. It also delivered better-than-expected Q2 earnings that showed recovering occupancy and better reimbursement rates.

I did also mention that Omega’s dividend had been outstripping its funds available for distribution (FAD), and that also reversed in Q2. The payout danger hasn’t completely passed yet—a large part of Omega’s business comes from LaVie Care Centers, with whom it’s currently in the midst of a deal restructuring—but optimism in OHI remains higher than it has been in years.

Universal Corp. (UVV)

Dividend Yield: 6.6%

1-Year Beta: 0.44

Stocks as a whole might be up in 2023, but consumer staples have had a crummy year. Take, for instance, Universal Corp. (UVV), a truly unique tobacco play.

Unlike, say, Philip Morris (PM) and Altria (MO), which produce cigarettes, Universal Corp. merely supplies the tobacco that goes into cigarettes and other tobacco products—for more than 30 companies across five continents.

Its business is further diversified via a separate ingredients operation that includes FruitSmart, Shank’s Extracts and Silva International. And it even as a third division, Universal Enterprises, that it bills as a “value-added agricultural” business, offering products and services such as software that helps track crop lifecycle data and lab testing of vaping products.

It’s a beautifully boring, behind-the-scenes play with not just a low 1-year beta, but a low longer-term (5-year) beta of 0.67. UVV doesn’t budge—and that’s not necessarily a compliment.

Tranquility—But at the Cost of Performance

The one thing UVV does have in common with tobacco producers is a high payout ratio in the upper 80s. So the dividend is technically sustainable, but there’s not much room for growth there, either.

Cal-Maine Foods (CALM)

Dividend Yield: 10.8%

1-Year Beta: 0.03

What could be more stable than Cal-Maine Foods (CALM)—an absolute titan of its consumers staples niche as America’s largest producer and distributor of eggs?

If we’re going just by the numbers, Cal-Maine’s ticker couldn’t be more on the money. With a 1-year beta of 0.03—in other words, just 3% as volatile as the market—no stock comes close to being as calm as CALM.

Unfortunately, Cal-Maine is a must-read tale about how first-level investors can get sucker punched by taking market metrics at face value alone.

Beta measures how much a stock moves compared to a benchmark, right? So, a low beta means if the stock market moves higher, the stock moves less. But you can also have negative beta—when the stock market moves higher, the stock moves less, but also in the opposite direction.

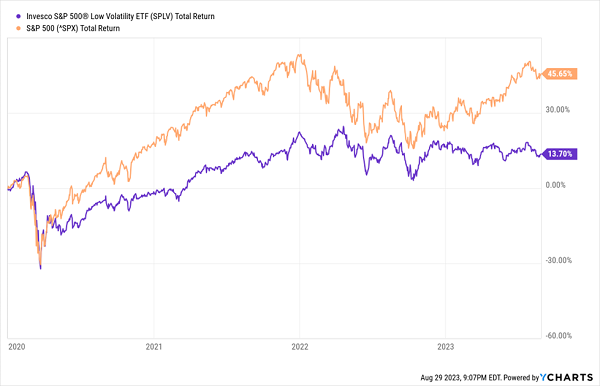

Combine that piece of knowledge with the reminder that beta is calculated over a longer period of time (in this case, one year), and you’ll realize that having an easy, breezy stock chart isn’t the only way to pop out a paper-thin beta:

Low Beta Usually Means Low Volatility … But Not Always

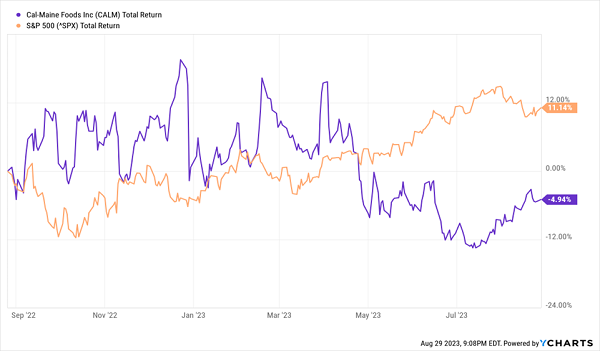

CALM’s nearly 11%-plus yield is less than meets the eye, too.

Cal-Maine is a self-described “variable” dividend payer, and it has been for 15 years. If you annualized its last payment, CALM would be yielding 18%. But because the payout is variable (and thus not dependable), you calculate yield based on the past four payments, and that gets us closer to 11%.

Even then, take a look at this 15-year payout history:

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks