2 Lithium Funds To Supercharge Your Portfolio

Lithium is one of the key components in rechargeable batteries. As the world heads towards a greener energy future, the demand for lithium is expected to rise dramatically. The shift towards electric vehicles, which require lithium as a key component in the batteries that power them, is putting a strain on global lithium supplies.

Lithium already is the key component in the batteries that power smaller electronics, such as smartphones and laptops. Electric vehicles are the largest consumer of lithium, and in 2022 demand for EV’s increased 57%. Investors can expect the price for lithium to follow suit.

The supply of lithium is small and scattered around the world. Analysts at Citigroup (C) predict that 75% of all mined lithium will go into EVs by 2025. There are only a limited number of public companies that mine and refine lithium making it hard for investors to find a low-risk way to play the sector.

The lithium battery industry is made up of suppliers, manufacturers, and individual component designers. There are expected to be more mergers that will help consolidate the industry. As such it is difficult to identify the best individual stock in the sector. Investing in an ETF is a much easier way to gain exposure to the industry.

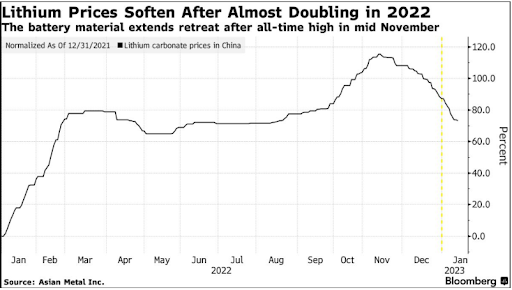

The price of Lithium reached record highs in late 2021 has dropped by more than 35% in the past six months. This could be due to a combination of factors, including an increase in lithium production and slower worldwide growth after the pandemic and higher interest rates.

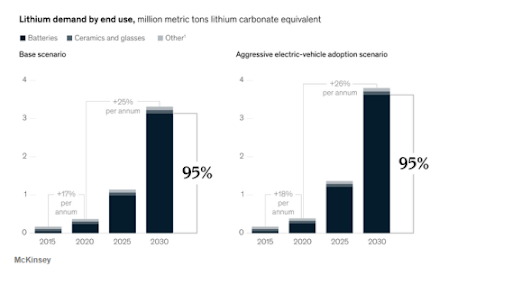

Government incentives to switch to electric vehicles and cleaner energy solutions are driving demand for EVs, which is leading analysts to forecast that lithium demand by 2040 will be 16 times higher than present-day levels.

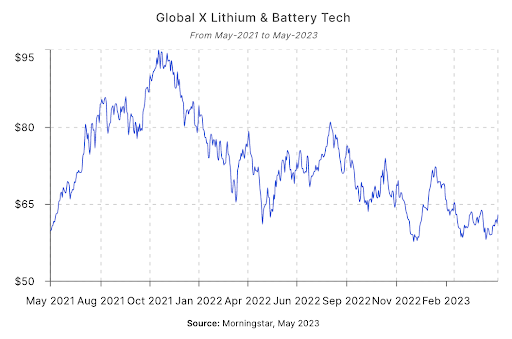

Two ETFs that investors can choose to play a diversified basket of stocks that include both mining companies and the battery manufacturers are the Global X Lithium & Battery Tech ETF (LIT) and the Amplify Lithium and Battery Technology ETF (BATT).

The LIT fund is the oldest and most popular of the Lithium focused ETFs. It was created back in 2010 and has over $3 Billion in assets under management. It comprises 39 stocks with Albemarle (ALB) as the top holding representing 8.1% of the fund. The company is the largest provider of lithium for electric vehicle batteries in the world. Battery manufacturers located in China and South Korea along with miners based in Chile are also included in the portfolio. Tesla (TSLA) at 2.3% gives some exposure to the EV end market.

LIT peaked in late 2021 near $97 per share coincided with the peak in lithium prices. The stock has since fallen back to as low as $58 per share, a level which can provide a base for renewed upside.

BATT launched in 2019 with over $150 million in assets and a net expense ratio of 0.59% even lower than LIT’s ratio of 0.75%. The fund holds 90 stocks and is more diversified in that it also holds exposure to other metals needed to manufacture rechargeable batteries such as cobalt. It also has heavier weighting towards the Asian lithium market including Chinese EV maker, BHP Group (BHP).

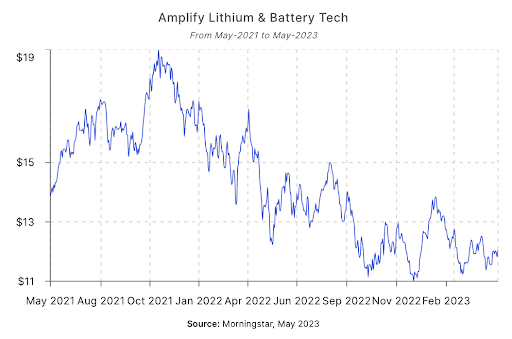

Since it is a relatively new ETF, it has underperformed since inception, as lithium prices have fallen. Shares reached a high point also in late 2021 of around $20 falling to the current lows and good support around the $12 level.

As demand for lithium and battery technology is expected to grow significantly investors should explore diversified ETFs instead of attempting to select individual companies to capitalize on the projected growth in the lithium and battery sector, which will play a critical role in the future of energy and transportation.

This post originally appeared at Option Sensei.

Category: Commodities, ETFs